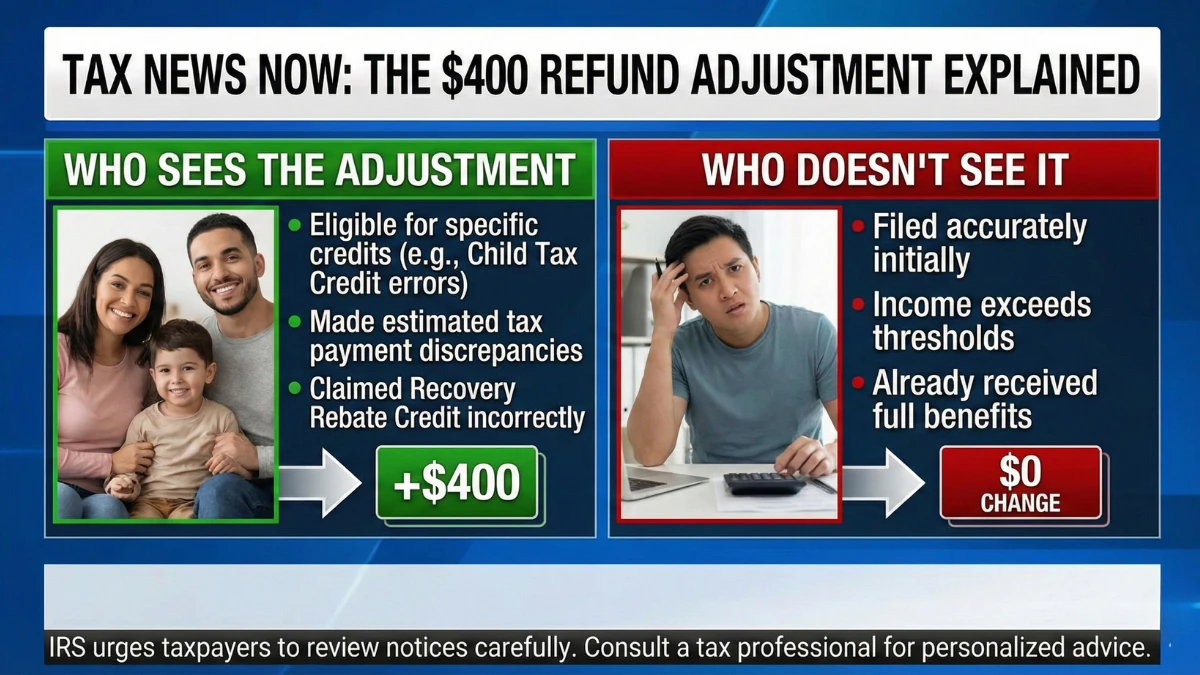

Why Some Taxpayers See $400 Refund Adjustments While Others Don’t

During recent tax seasons, many filers have noticed IRS refund adjustments of about $400, while others with seemingly similar returns receive exactly what they expected, creating confusion and concern. These differences are usually not random and rarely indicate penalties. This article explains why $400 adjustments happen, why some taxpayers are affected while others are not, … Read more