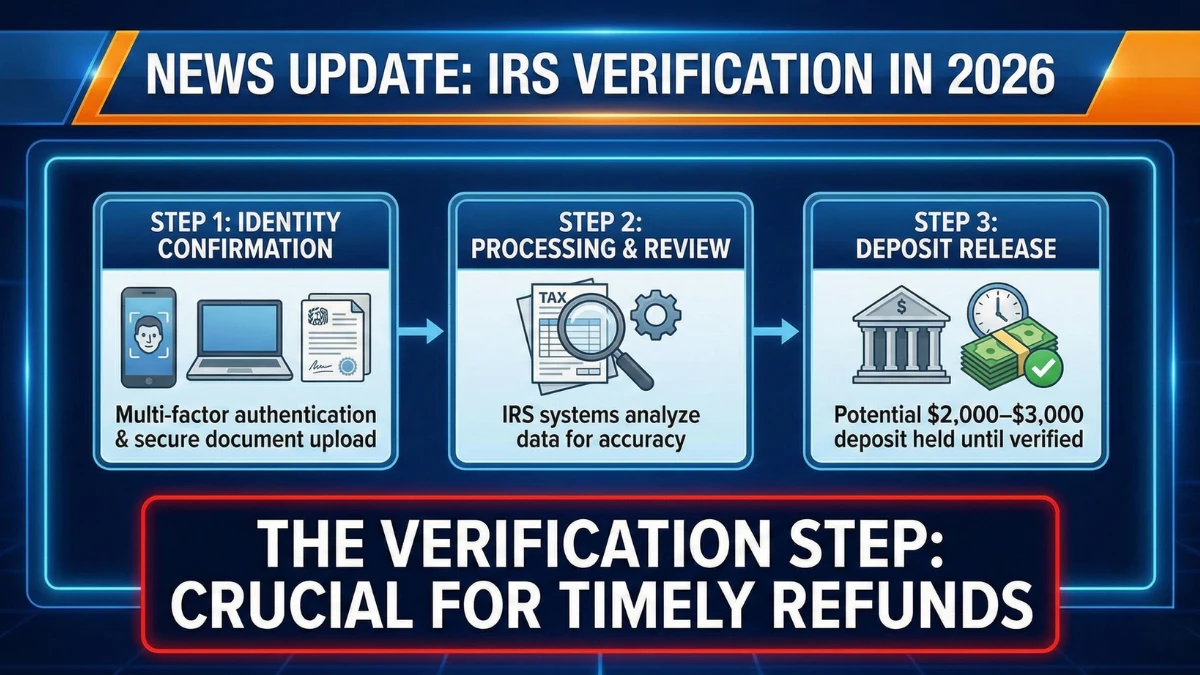

IRS Verification in 2026 Explained: The Step That Can Hold $2,000–$3,000 Deposits

In the 2026 tax season, many taxpayers expecting $2,000–$3,000 IRS deposits are seeing their refunds pause during IRS verification, creating anxiety about delays or reductions. This verification step is a standard part of federal processing and does not automatically signal a problem. This article explains what IRS verification is, why it affects mid-to-higher refunds, and … Read more