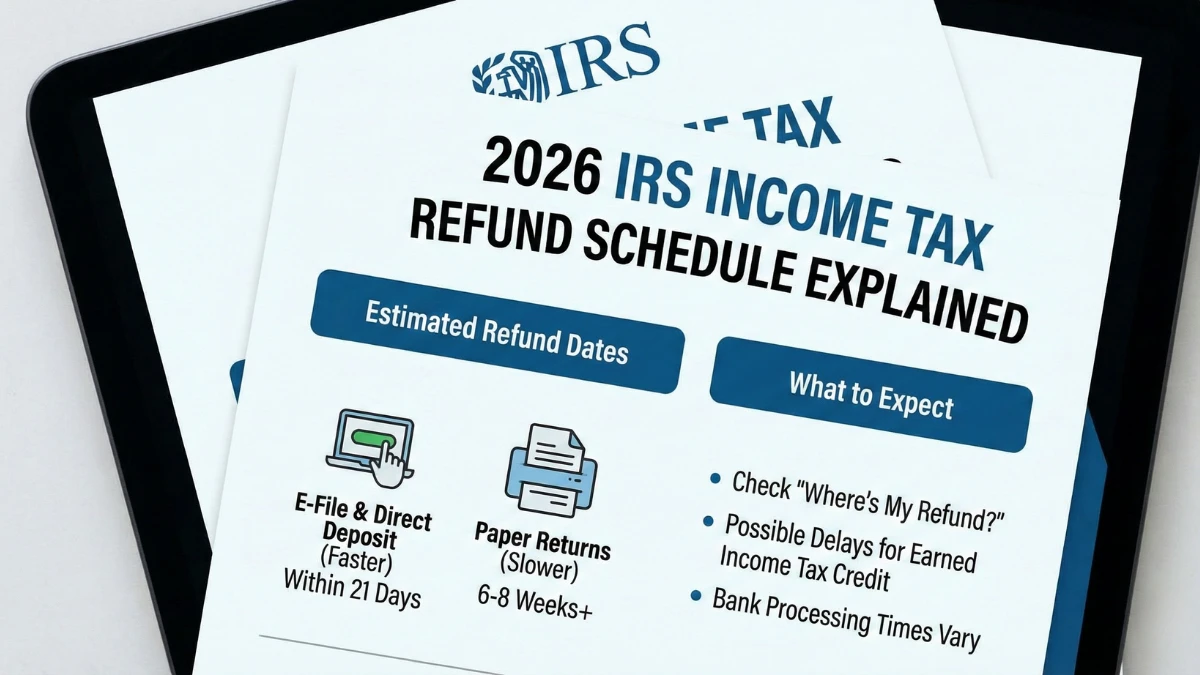

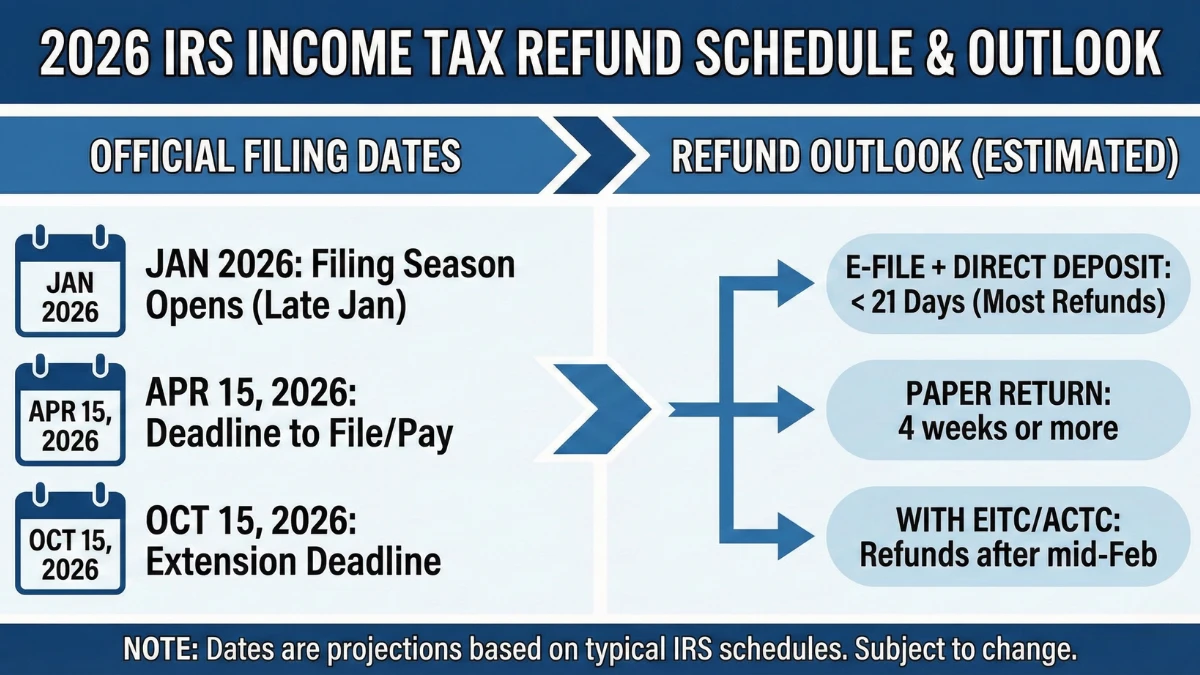

2026 IRS Income Tax Refund Schedule Explained: Estimated Refund Dates and What to Expect

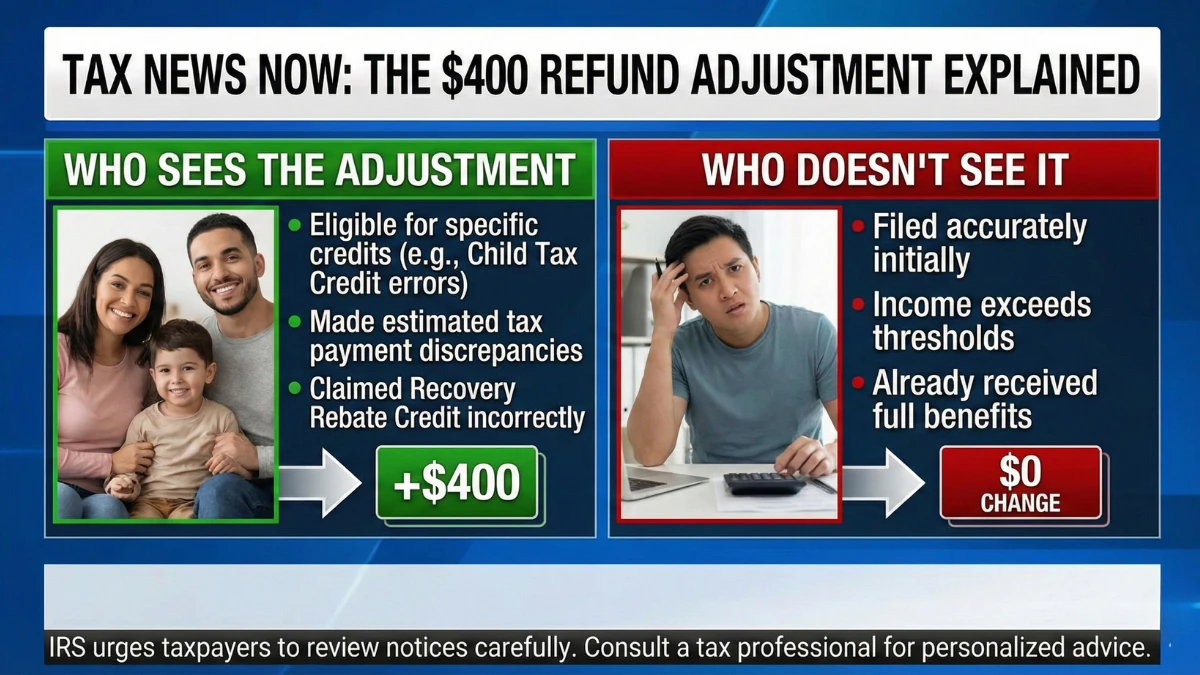

As the 2026 tax season begins, taxpayers are searching for the IRS income tax refund schedule to understand when their refunds might arrive and why timelines differ from filer to filer. While the IRS does not publish an exact refund calendar for each taxpayer, estimated refund windows can be predicted based on filing method, credits … Read more