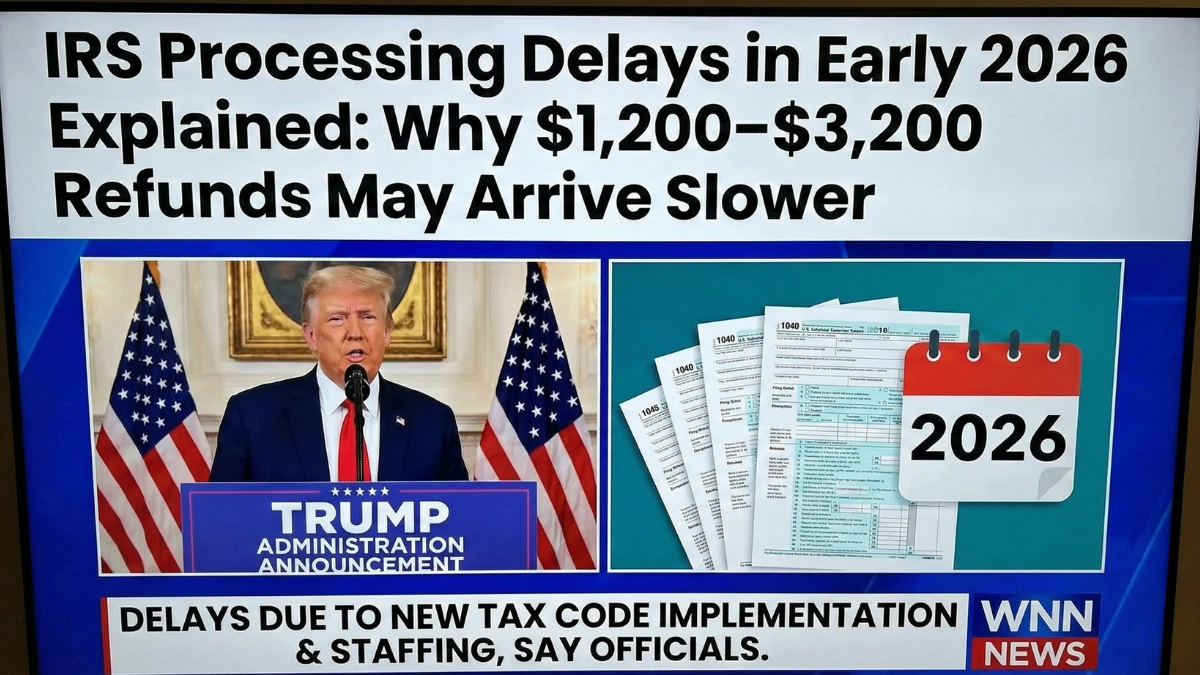

IRS Processing Delays in Early 2026 Explained: Why $1,200–$3,200 Refunds May Arrive Slower

Early 2026 has brought noticeable IRS processing delays, especially for taxpayers expecting refunds between $1,200 and $3,200, leading to frustration and confusion about slow-moving deposits. These delays are not random and do not indicate lost or denied refunds. This article explains the real reasons behind slower payouts, how federal processing works, and what filers should … Read more