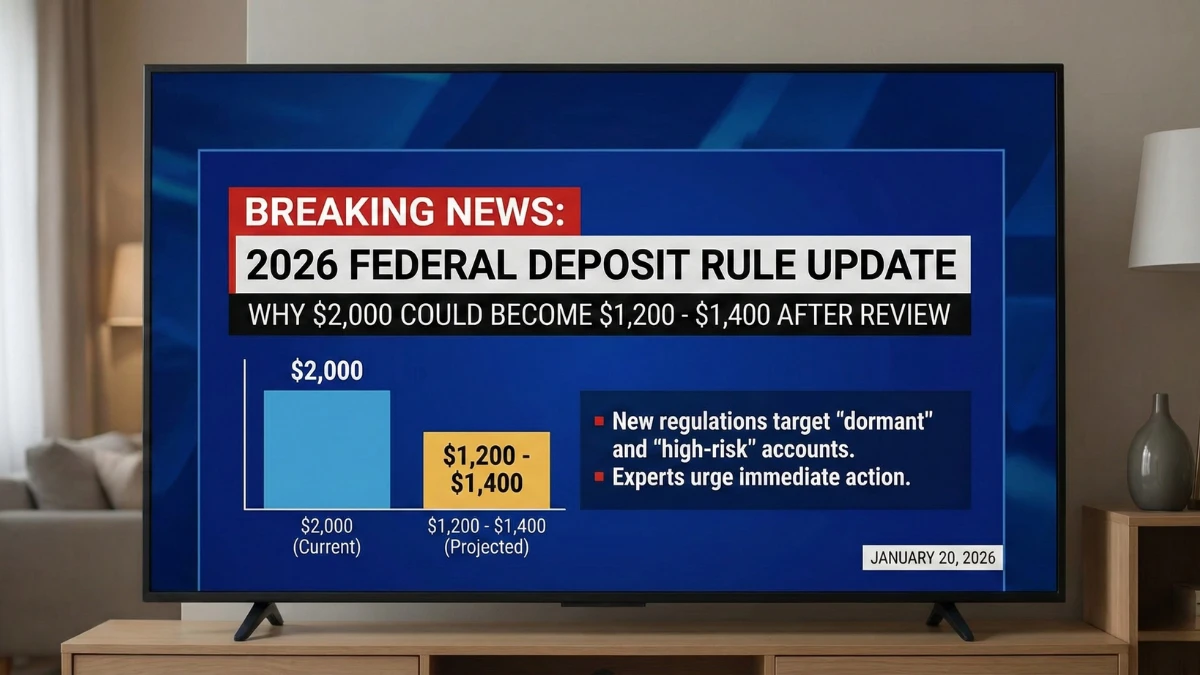

Federal Deposit Rules Update for 2026: Why a $2,000 Refund Can Drop to $1,200–$1,400 After Review

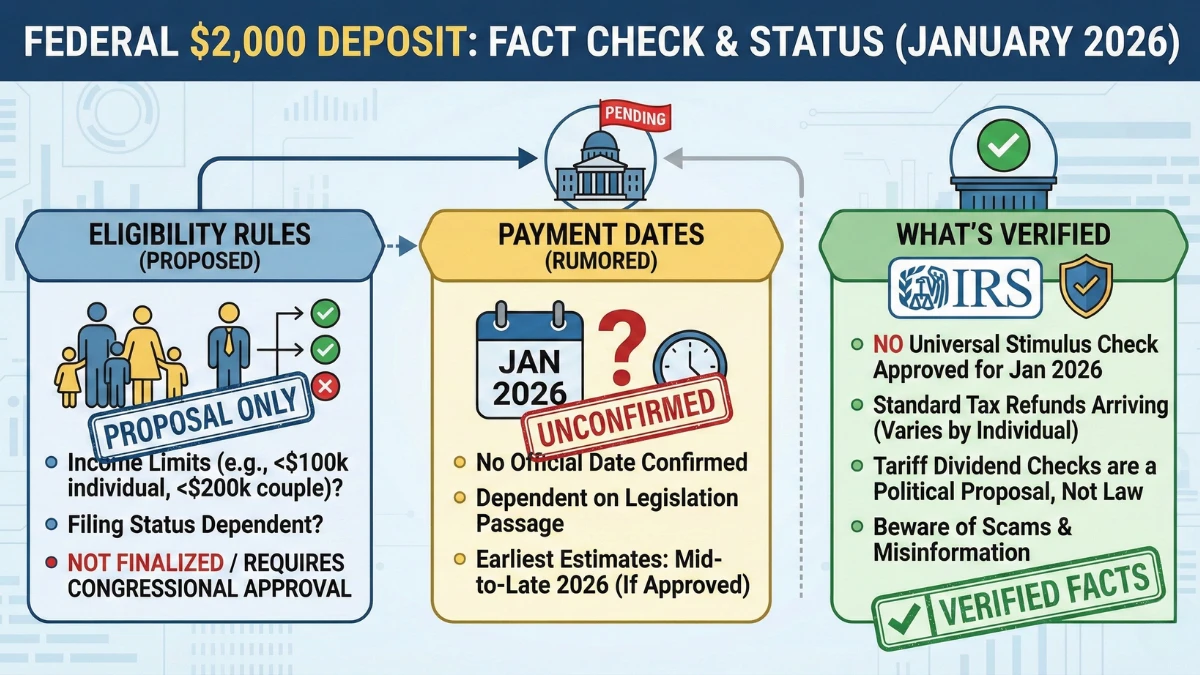

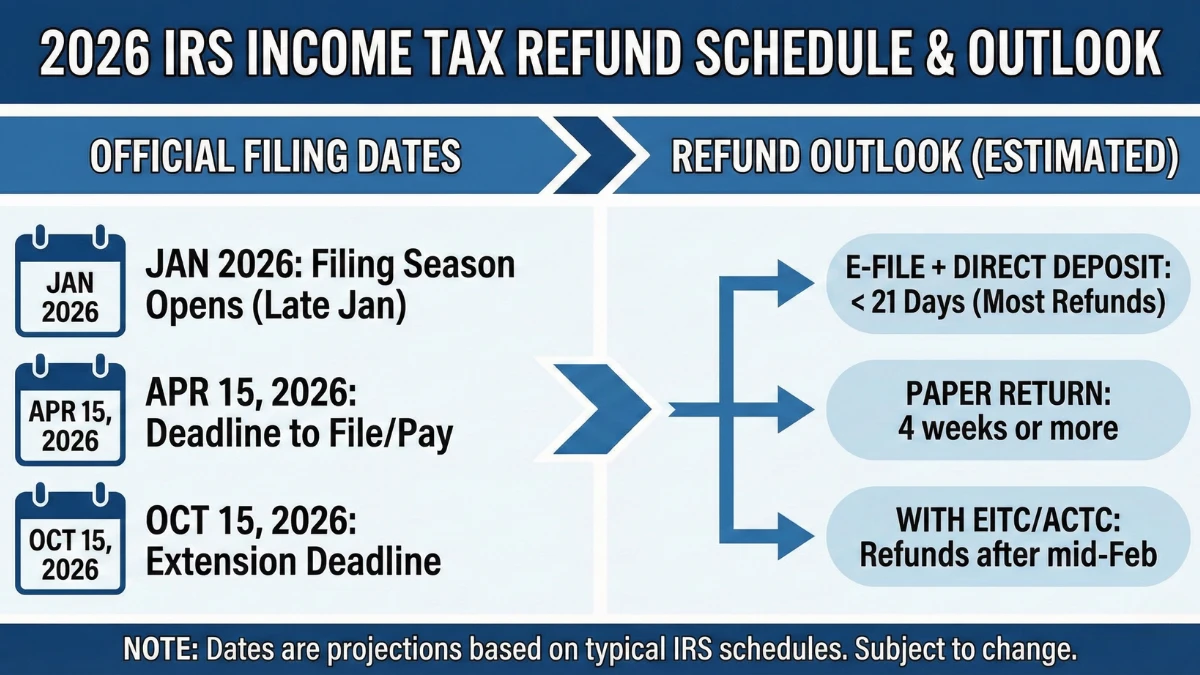

In 2026, many taxpayers are surprised to see an expected $2,000 federal refund reduced to $1,200–$1,400 after IRS review, even when their return was filed correctly. This change is not random and does not automatically mean a penalty. It reflects updated federal deposit and verification rules that adjust refunds after income, credits, and withholding are … Read more