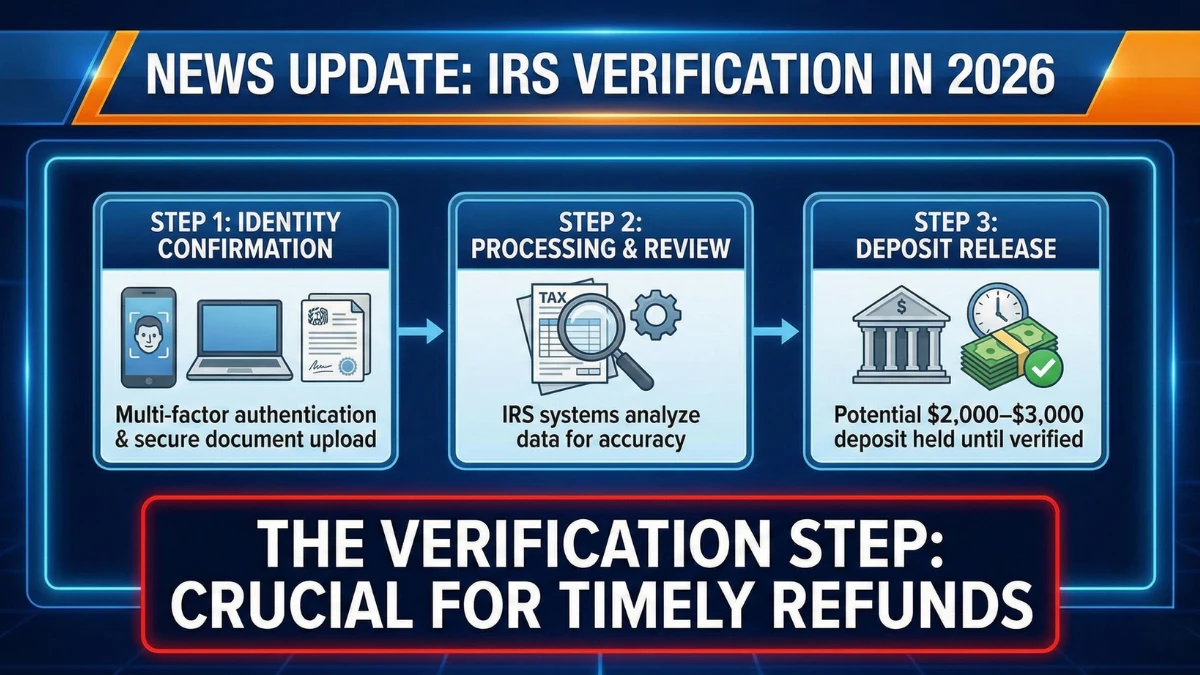

Federal Deposit Reviews Expand in 2026: Why $3,000+ IRS Refunds Are Taking Longer

In 2026, taxpayers expecting IRS refunds above $3,000 are increasingly encountering longer wait times as federal deposit reviews expand, adding extra verification steps before payments are released. These delays are not penalties and do not mean refunds are denied. This article explains why higher-value refunds are moving more slowly, what changed in 2026, and how … Read more