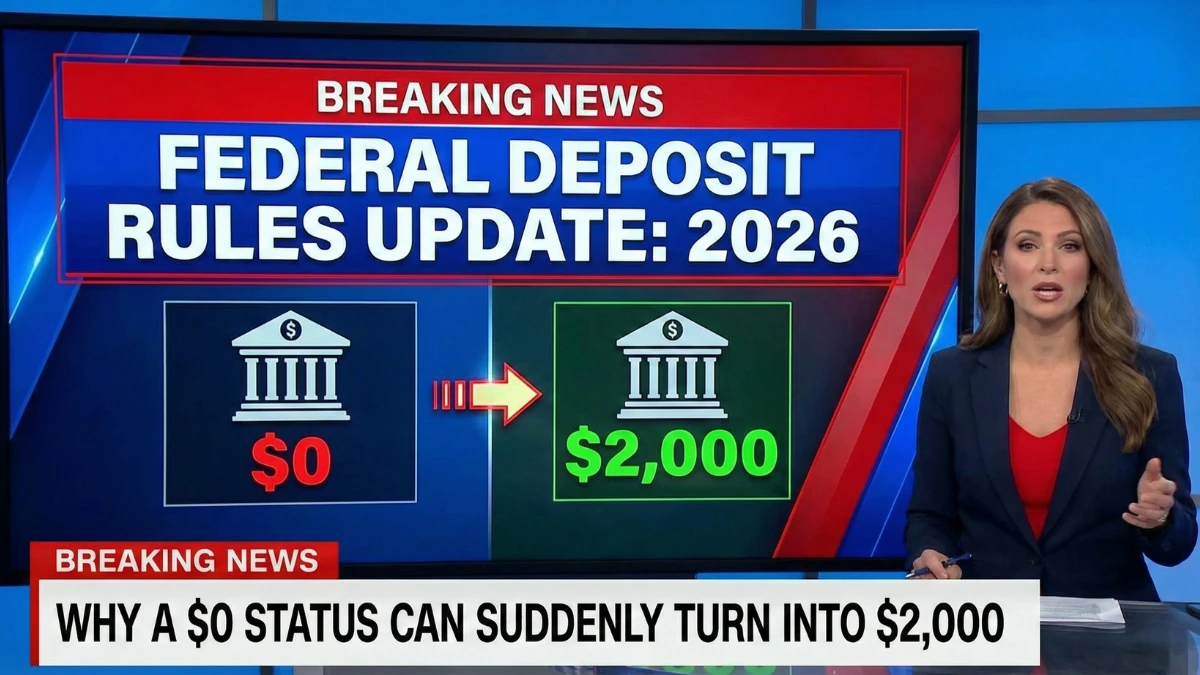

Federal Deposit Rules Update in 2026: Why a $0 Status Can Suddenly Turn Into $2,000

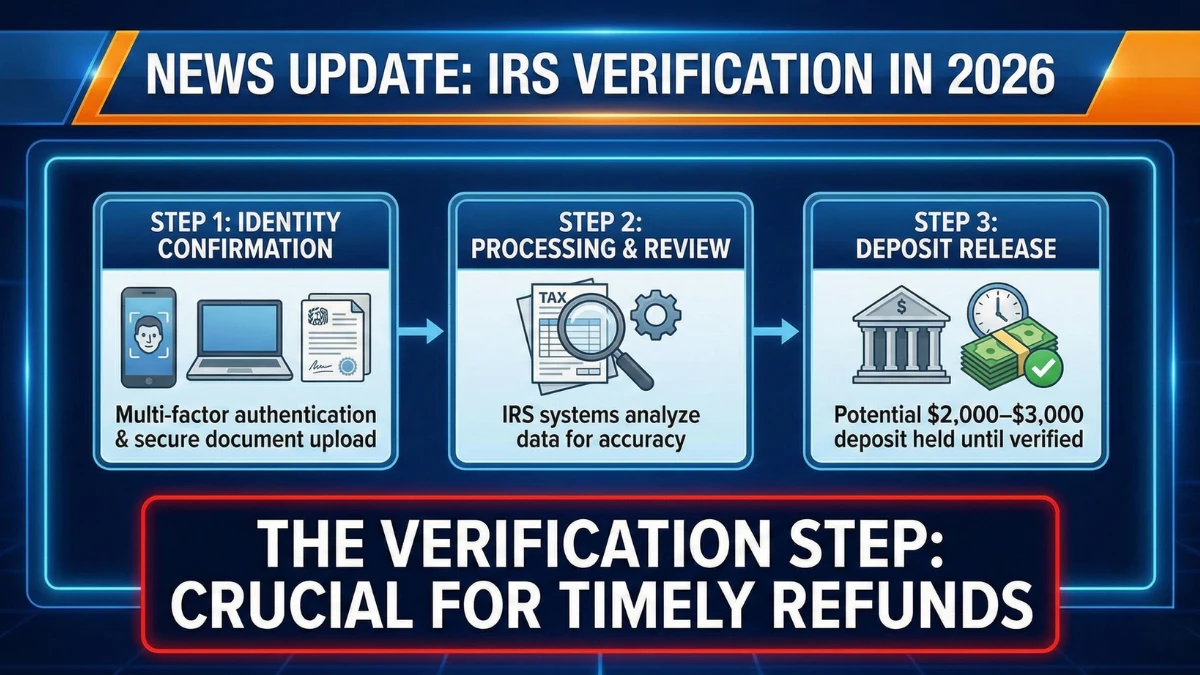

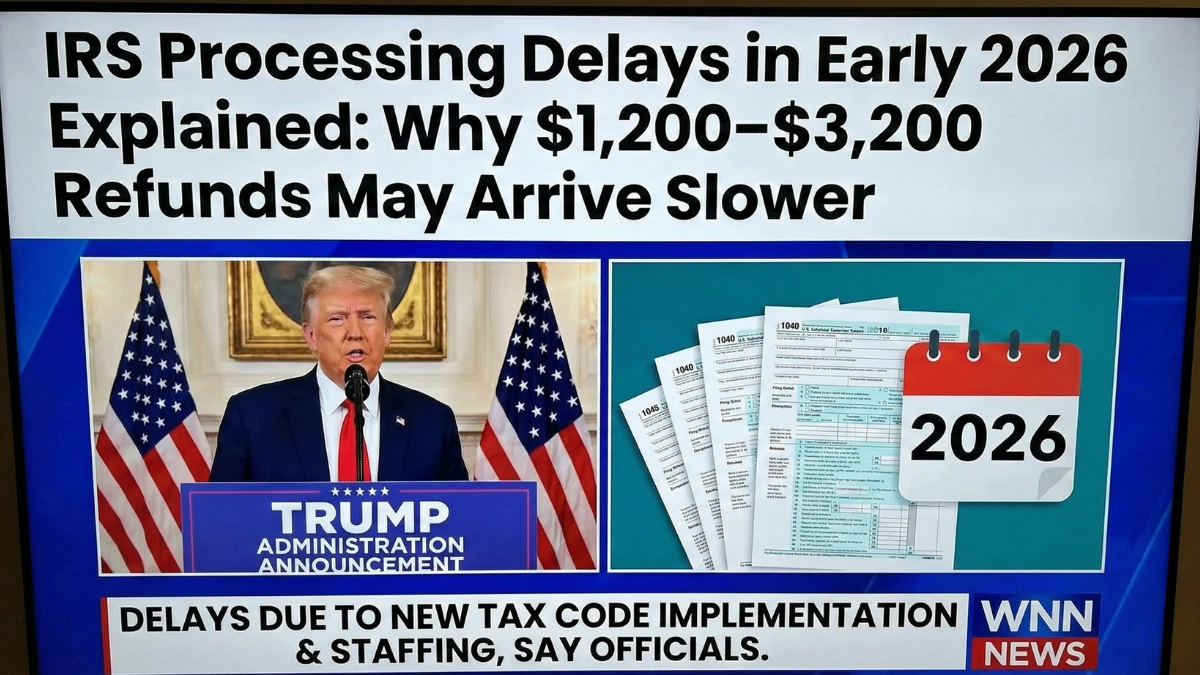

In 2026, many taxpayers checking their refund status are seeing a confusing pattern where an account shows $0 pending, only to later receive a $2,000 federal deposit without warning. This sudden change is not a system error or surprise payment, but the result of updated federal processing and verification rules. This article explains why the … Read more