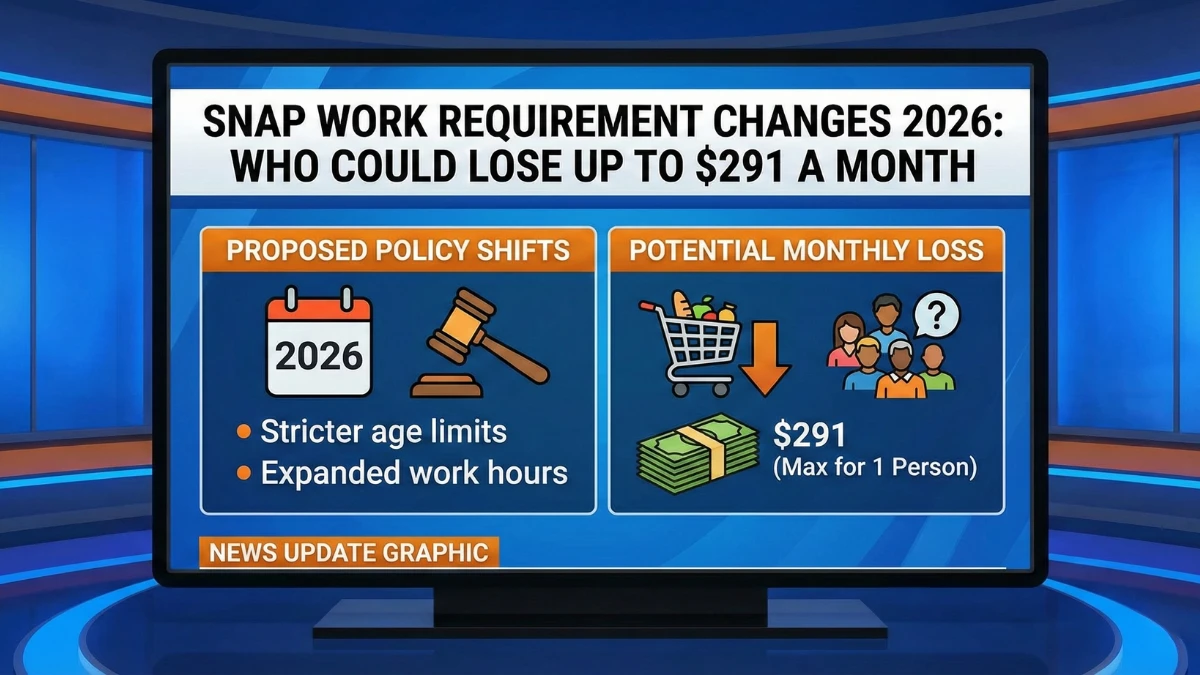

In 2026, updated SNAP work requirements are affecting eligibility for certain recipients, raising concerns about how monthly benefits—often up to $291 for a single-person household—may change or pause if conditions are not met. These updates do not end SNAP, but they do tighten compliance rules for specific groups. This article explains what the new work requirements mean, who is impacted, and how the program continues to operate under guidance from the U.S. Department of Agriculture.

What the New SNAP Work Requirements Mean in 2026

The 2026 changes reinforce existing rules for Able-Bodied Adults Without Dependents (ABAWDs), requiring qualifying recipients to meet work or training conditions to continue receiving benefits beyond limited timeframes.

| Rule Area | 2026 Update |

|---|---|

| Work Requirement | Mandatory for certain adults |

| Minimum Activity | Work or training hours required |

| Time Limit | Benefits limited if rules unmet |

| Exemptions | Seniors, disabled, caregivers |

| Enforcement | Increased verification |

Why the $291 Monthly Benefit Is Mentioned

The $291 amount reflects the maximum monthly SNAP benefit for a single-person household under recent federal guidelines. Recipients who fail to meet work requirements risk temporary suspension or reduction of this benefit.

Who Is Most Affected by the 2026 Rules

The changes primarily impact:

- Adults aged 18–54 without dependents

- Recipients not meeting work or training thresholds

- Individuals no longer covered by state waivers

Most families, seniors, and disabled recipients are not affected.

Who Is Exempt From Work Requirements

Exemptions remain in place for:

- Seniors (60+)

- Disabled individuals

- Pregnant individuals

- Caregivers

- Medically unfit recipients

These groups continue receiving SNAP without work conditions.

How States Enforce the New Rules

States administer SNAP and are responsible for:

- Verifying employment or training participation

- Issuing notices before benefit changes

- Offering qualifying work programs

- Applying time limits only when required

States cannot end SNAP but must follow federal policy.

What Happens If Requirements Are Not Met

If a non-exempt recipient does not meet work rules:

- SNAP benefits may pause after the allowed months

- Eligibility can resume once requirements are met

- Benefits are not permanently lost

What SNAP Recipients Should Do Now

Recipients should:

- Review state SNAP notices carefully

- Enroll in approved work or training programs if required

- Report changes in work status promptly

- Check eligibility before assuming benefit loss

Key Points to Remember

- SNAP is not ending in 2026

- Work rules target specific adult groups

- $291 is the max single-person benefit

- Exemptions still apply

- Benefits can resume after compliance

Conclusion

The introduction of new SNAP work requirement enforcement in 2026 does not eliminate food assistance but does affect certain adults whose monthly benefits—up to $291—depend on meeting participation rules. Understanding exemptions and state-specific guidance is key to maintaining eligibility and uninterrupted benefits.

Disclaimer

This article is for informational purposes only and does not constitute legal or benefits advice. SNAP rules, benefit amounts, and work requirements are subject to federal and state regulations. Recipients should rely on official state SNAP agencies or USDA guidance for accurate, up-to-date information.