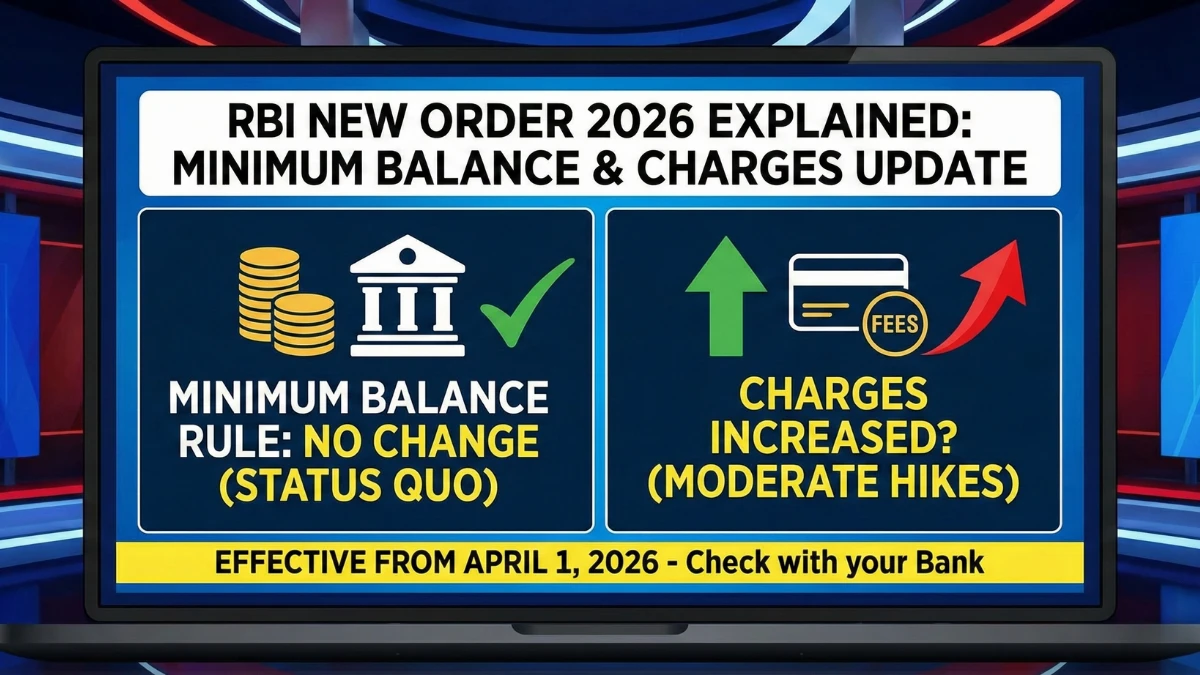

Reports claiming an RBI new order in 2026 changing minimum balance rules and increasing bank charges are spreading quickly, causing concern among savings account holders across India. Because minimum balance penalties directly affect daily banking costs, it is important to clearly understand what the Reserve Bank of India has actually mandated and what remains a bank-level decision. This article explains the real status, what is officially confirmed, and what customers should expect.

Does RBI Decide Minimum Balance Rules for Banks

The RBI does not fix a uniform minimum balance for all savings accounts. Instead, it issues broad regulatory and consumer-protection guidelines, while individual banks decide minimum balance requirements and penalty charges based on account type and location.

| Rule Area | Who Decides |

|---|---|

| Minimum Balance Amount | Individual banks |

| Penalty Charges | Individual banks |

| Zero Balance Accounts (BSBDA) | RBI mandate |

| Customer Disclosure Rules | RBI |

| Banking Supervision | RBI |

Has RBI Issued a New Minimum Balance Order for 2026

As of now, no official RBI notification confirms a nationwide change in minimum balance rules or an across-the-board increase in charges for 2026. Claims of a single RBI “new order” are not supported by any published circular.

Why Customers Are Seeing Higher Charges

In many cases, banks periodically revise:

- Minimum balance limits

- Penalty structures

- Service charges

These changes are bank-specific policy updates, not RBI-imposed rules, but they are often misreported as RBI orders.

What RBI Rules Already Protect Customers

Under existing RBI norms, banks must offer Basic Savings Bank Deposit Accounts (BSBDA), which:

- Require no minimum balance

- Carry no penalty for zero balance

- Provide essential banking services

These protections continue unchanged unless officially revised.

Who Is Most Affected by Minimum Balance Penalties

Regular savings account holders in urban and metro areas are usually most affected, while BSBDA holders, pensioners, students, and certain senior citizens often receive exemptions depending on bank policy.

What Bank Customers Should Do Now

Customers should check:

- Their account type (regular savings vs BSBDA)

- Bank website or official notices

- SMS/email alerts from the bank

- Branch or customer-care clarification

This ensures clarity before assuming a rule change.

- No confirmed RBI order changing minimum balance rules

- No nationwide charge hike announced by RBI

- Banks can revise charges independently

- Zero-balance accounts remain protected

- Always verify directly with your bank

Conclusion

Despite viral headlines, there is no confirmed RBI new order in 2026 mandating higher minimum balances or increased charges across banks. Most changes seen by customers are bank-level decisions, not RBI directives. Account holders should rely on official bank communications and RBI circulars, not unverified claims.

Disclaimer

This article is for informational purposes only and does not constitute legal or financial advice. Banking charges and minimum balance requirements are subject to bank policies and RBI guidelines. Customers should verify details with their respective banks or official RBI notifications.