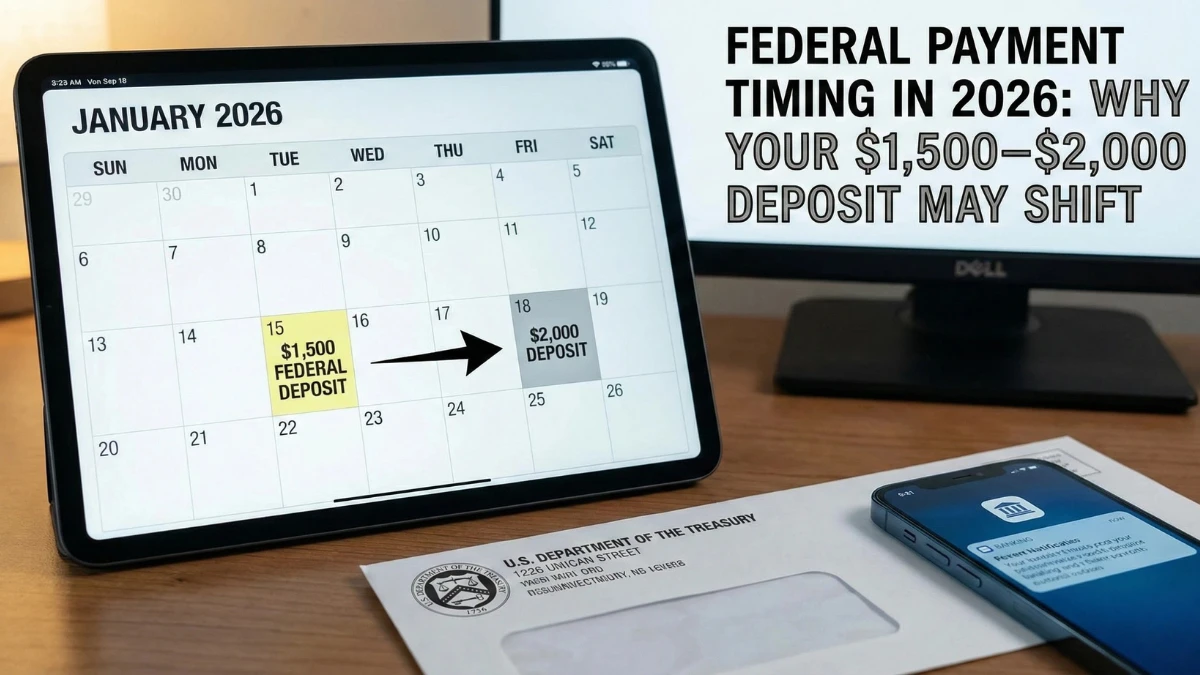

Federal Deposit Update Explained: How a $0 Status Can Turn Into $2,000 After Verification

Many taxpayers are surprised to see their federal deposit status show $0 and then suddenly update to $2,000 after verification is completed, creating confusion and concern about whether a payment was denied or delayed. In most cases, this change is part of normal federal processing and not an error. This article explains why verification matters, … Read more