Federal $2,000 Deposit Arriving January 2026: Complete Guide for Beneficiaries

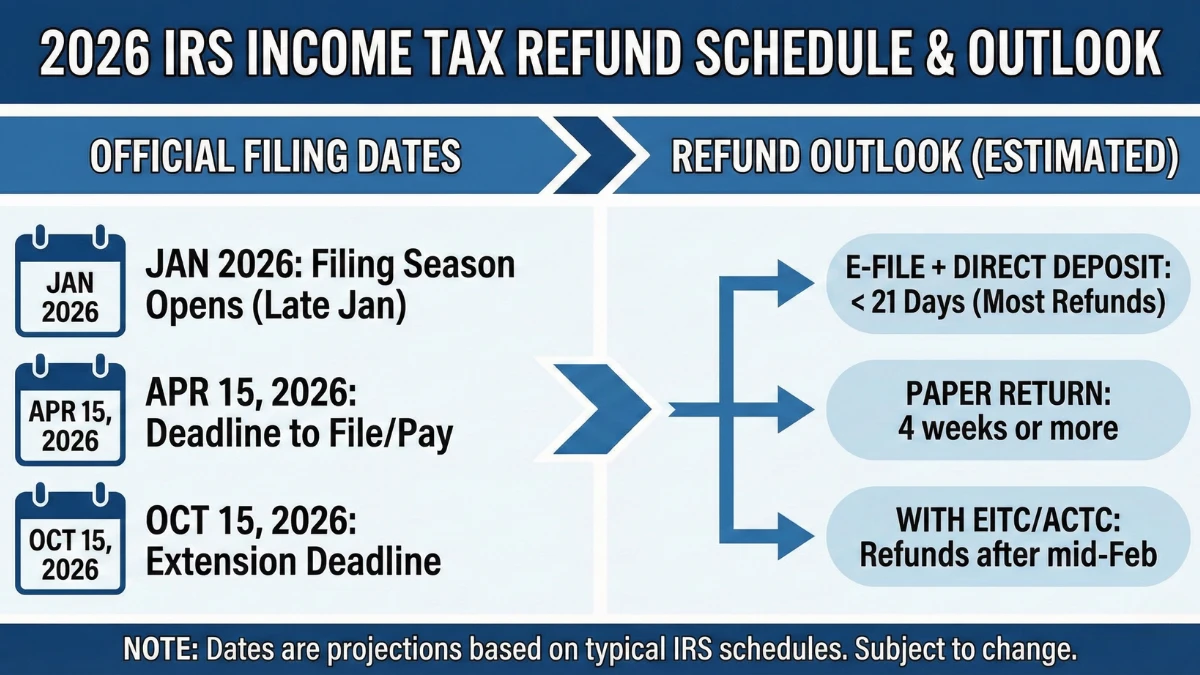

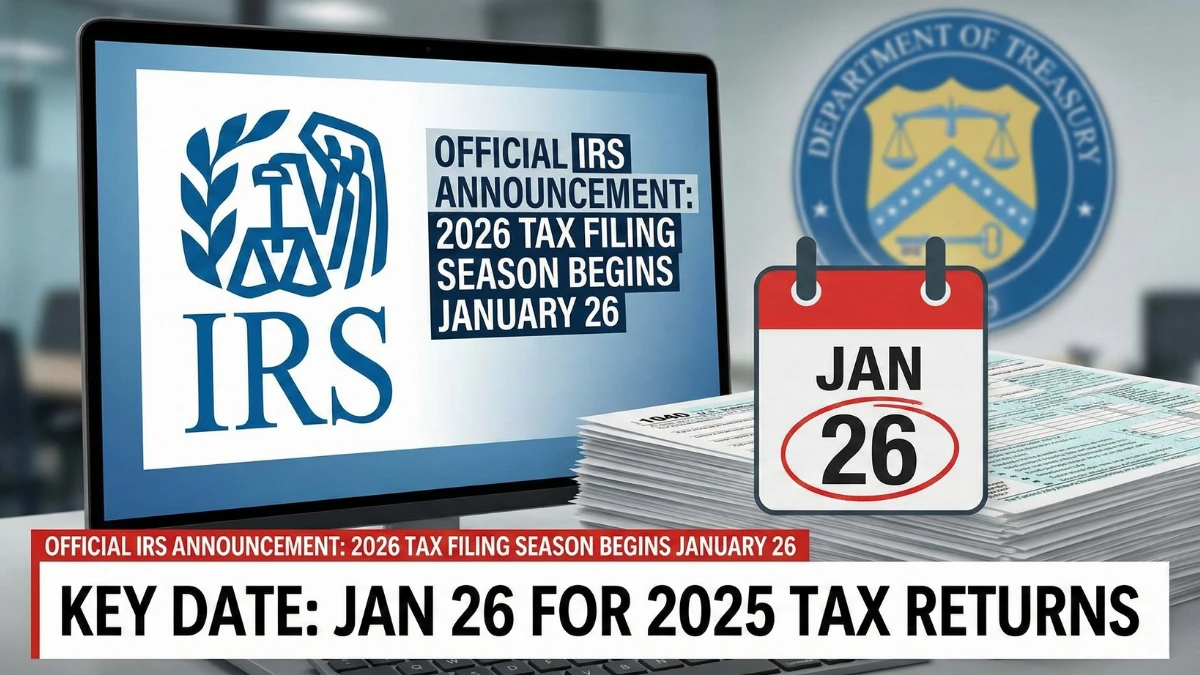

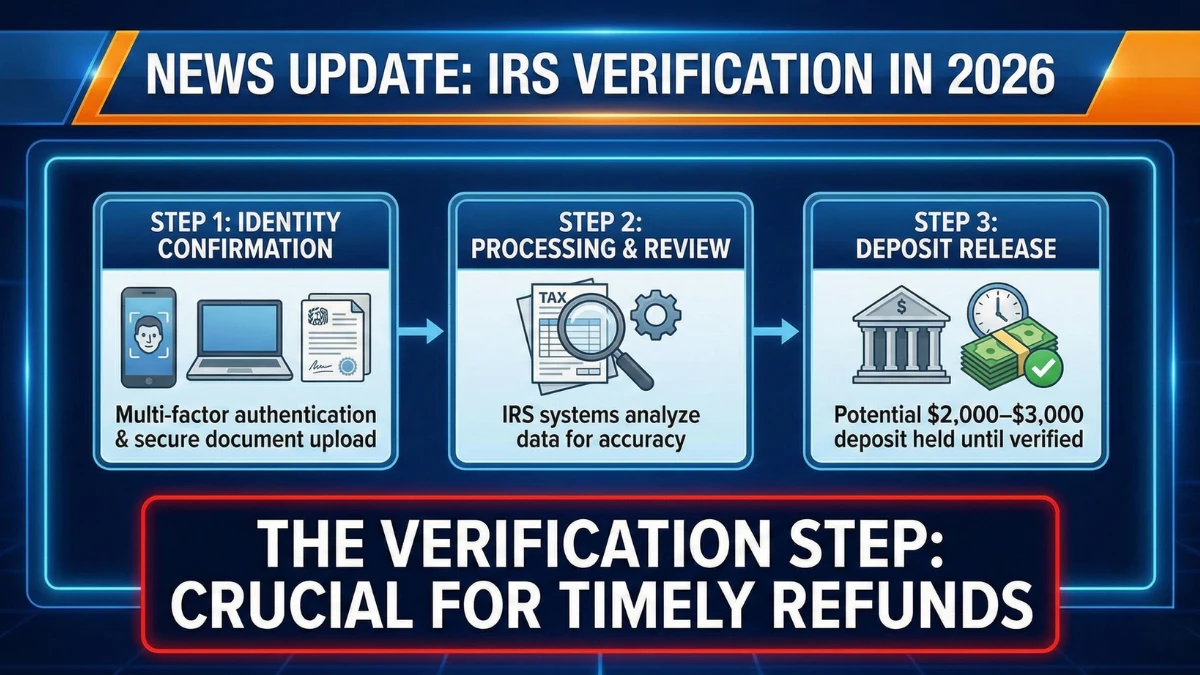

As January 2026 approaches, renewed attention around a Federal $2,000 deposit has left many beneficiaries wondering whether a confirmed payment is coming, who qualifies, and when funds may arrive. While deposits near $2,000 do appear for some taxpayers early in the year, they are not universal payments and are tied to individual tax processing outcomes. … Read more