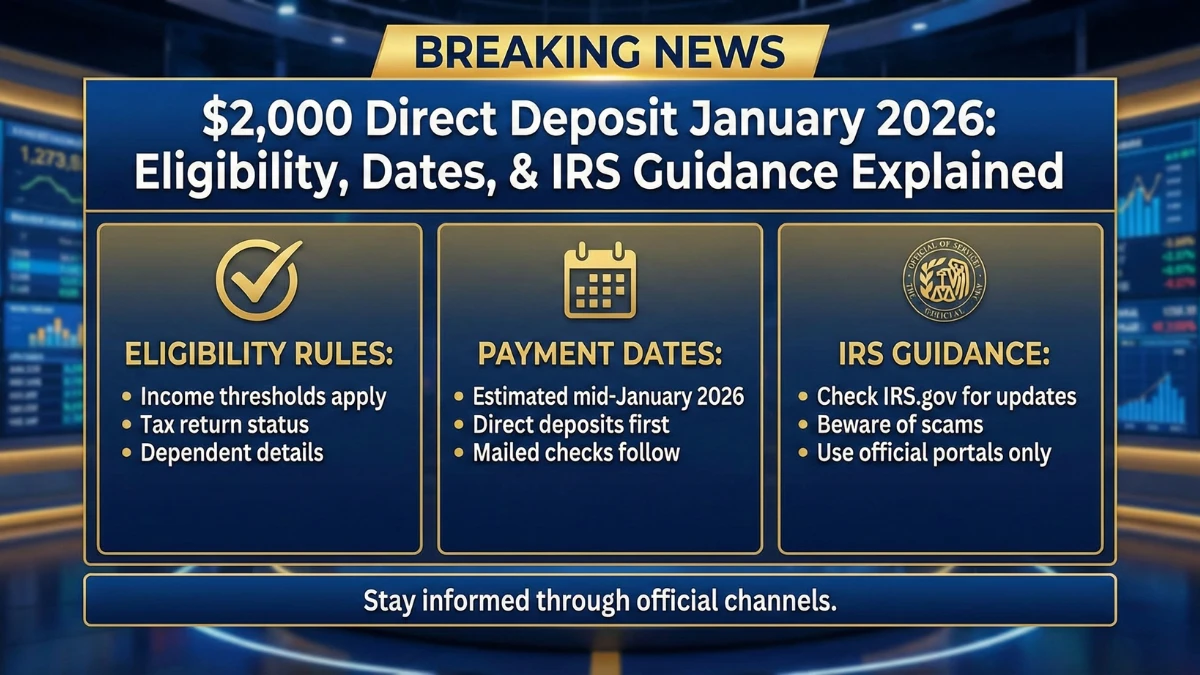

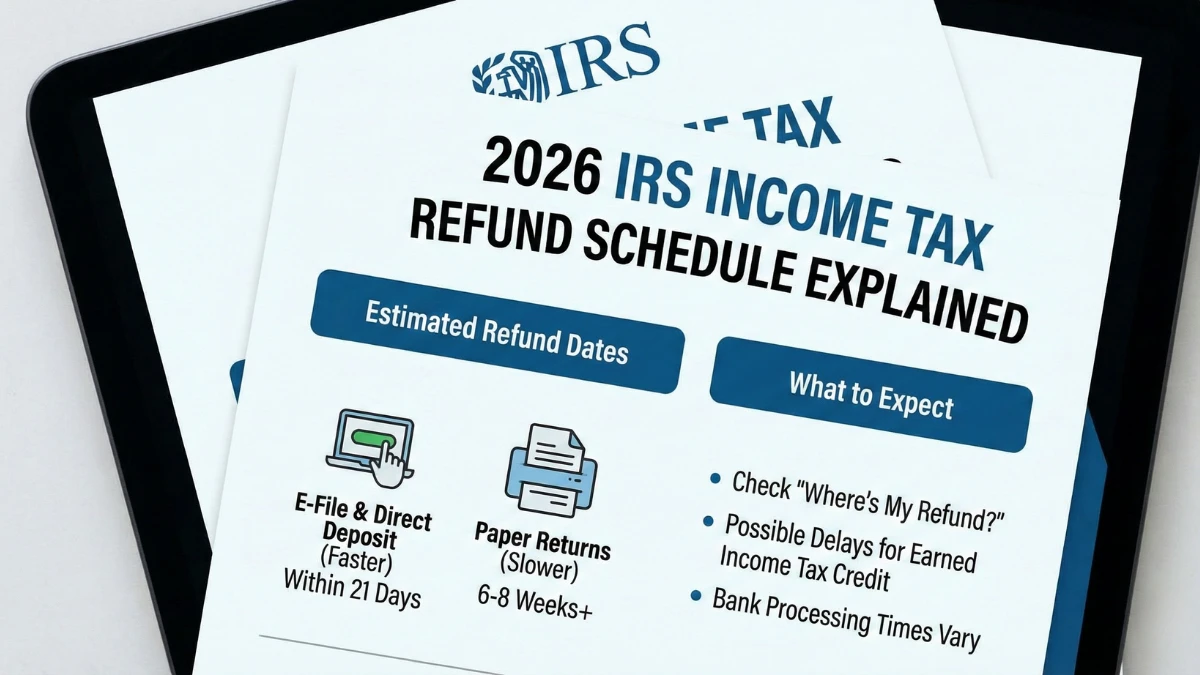

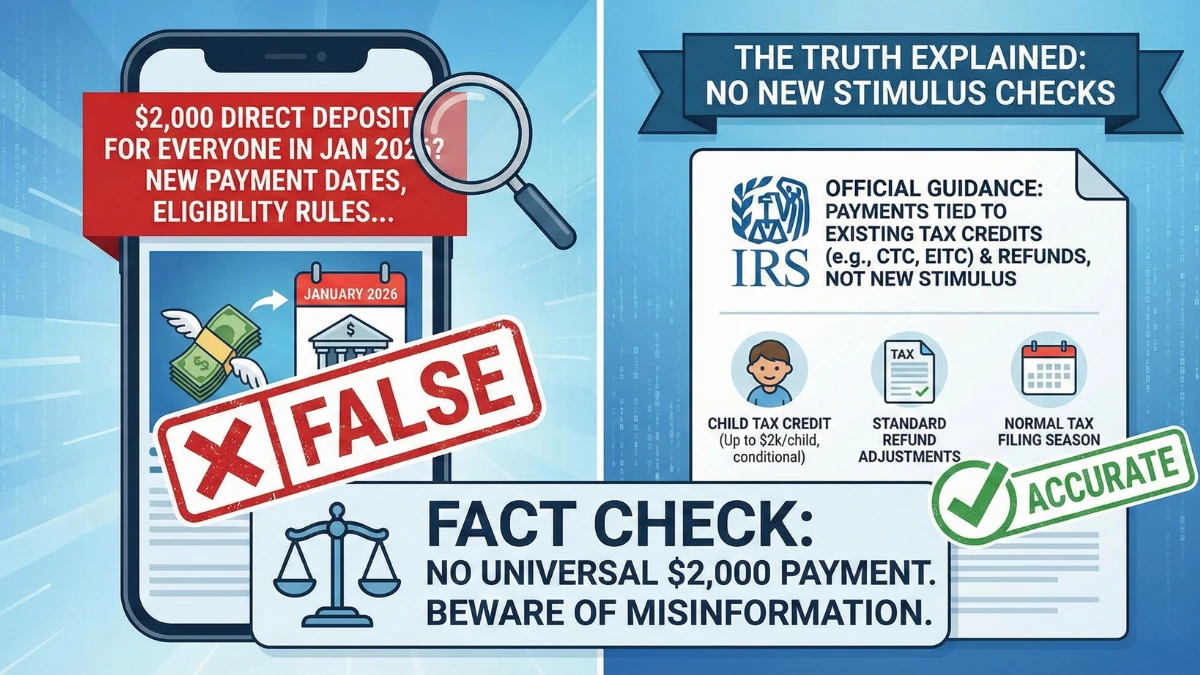

$2,000 Direct Deposit January 2026 Explained: Eligibility Rules, Payment Dates, and IRS Guidance

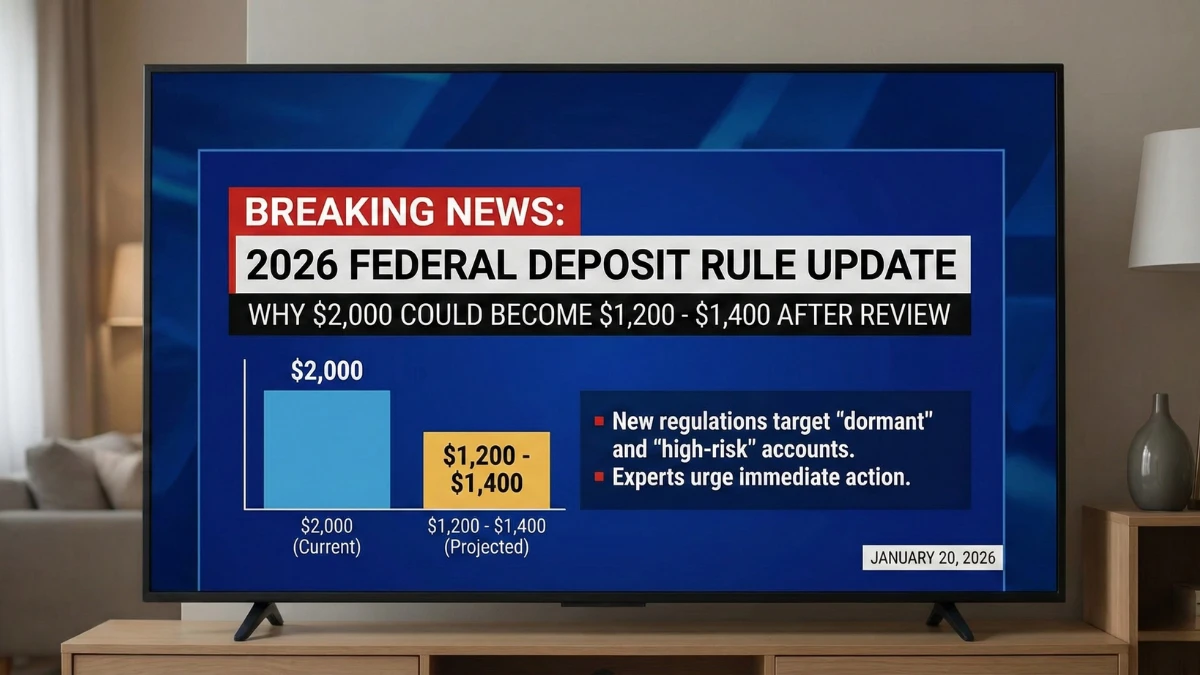

Claims about a $2,000 direct deposit arriving in January 2026 have gained widespread attention, with many Americans searching for eligibility details, payment dates, and official instructions. While the idea of a guaranteed deposit is appealing, the facts depend entirely on legislation and agency approval. This article clearly explains what is confirmed, what is not, and … Read more