The Post Office National Savings Certificate (NSC) Scheme 2026 remains a popular government-backed investment choice for individuals seeking guaranteed returns with tax benefits. With a fixed tenure and low risk, NSC is widely used for long-term savings and tax planning. This article explains the latest eligibility rules, interest structure, and the correct process to apply for NSC in 2026.

What Is the Post Office NSC Scheme

The National Savings Certificate is a fixed-income savings scheme issued by India Post on behalf of the Government of India, designed to encourage disciplined savings among individuals.

| Feature | Details |

|---|---|

| Scheme Type | Government savings scheme |

| Tenure | 5 years |

| Risk Level | Very low |

| Return Nature | Guaranteed |

| Issuer | Government of India |

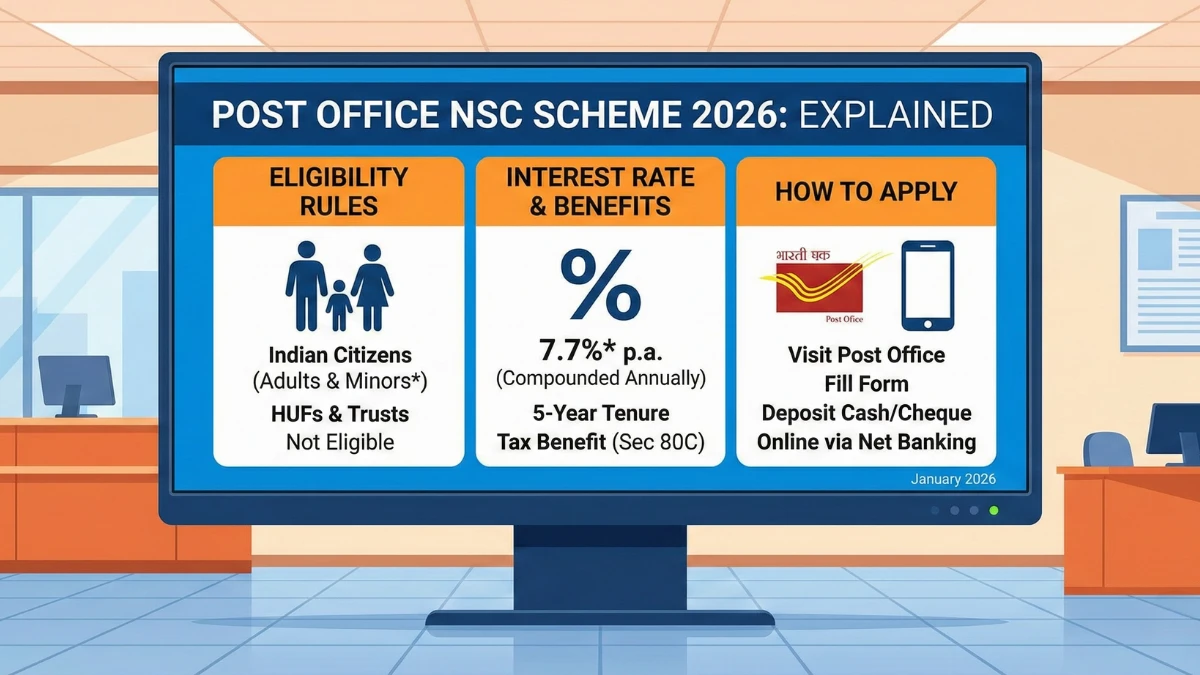

NSC Eligibility Rules in 2026

The NSC scheme is open to most residents with simple eligibility conditions.

| Eligibility Factor | Rule |

|---|---|

| Residency | Indian residents only |

| Age Limit | No minimum or maximum |

| Account Type | Single or joint |

| Minor Investment | Allowed via guardian |

| NRI / HUF | Not eligible |

Post Office NSC Interest Rate Structure

The NSC interest rate is fixed at the time of investment and remains unchanged for the full 5-year tenure. Interest is compounded annually and paid at maturity, ensuring predictable returns.

Tax Benefits Available Under NSC

NSC investments qualify for tax benefits under Indian tax laws:

- Eligible for Section 80C deduction

- Interest is taxable but deemed reinvested

- No TDS deducted at source

How NSC Maturity Amount Works

Interest earned is added to the principal every year and compounded. The full maturity amount is paid after completion of the 5-year lock-in period, making NSC suitable for long-term financial goals.

How to Apply for Post Office NSC in 2026

NSC can be purchased through post offices or digital channels linked to India Post.

Application Process

- Visit a post office branch or use approved online services

- Fill out the NSC application form

- Submit KYC documents (Aadhaar, PAN)

- Choose investment amount

- Make payment

- Receive NSC certificate (physical or electronic)

Who Should Invest in NSC

NSC is suitable for:

- Risk-averse investors

- Salaried individuals seeking tax savings

- Parents planning future expenses

- Senior citizens wanting capital safety

- First-time investors

Key Points Investors Must Know

- 5-year lock-in period

- Government-backed guarantee

- Section 80C tax benefit

- Interest compounded annually

- Limited premature withdrawal options

Conclusion

The Post Office NSC Scheme 2026 continues to be a reliable and tax-efficient savings option for individuals prioritizing safety and assured returns. With straightforward eligibility rules and government backing, NSC remains a strong choice for disciplined long-term investment.

Disclaimer

This article is for informational purposes only and does not constitute financial or investment advice. Interest rates, tax benefits, and scheme rules may change based on government notifications. Investors should verify details through official India Post sources before investing.