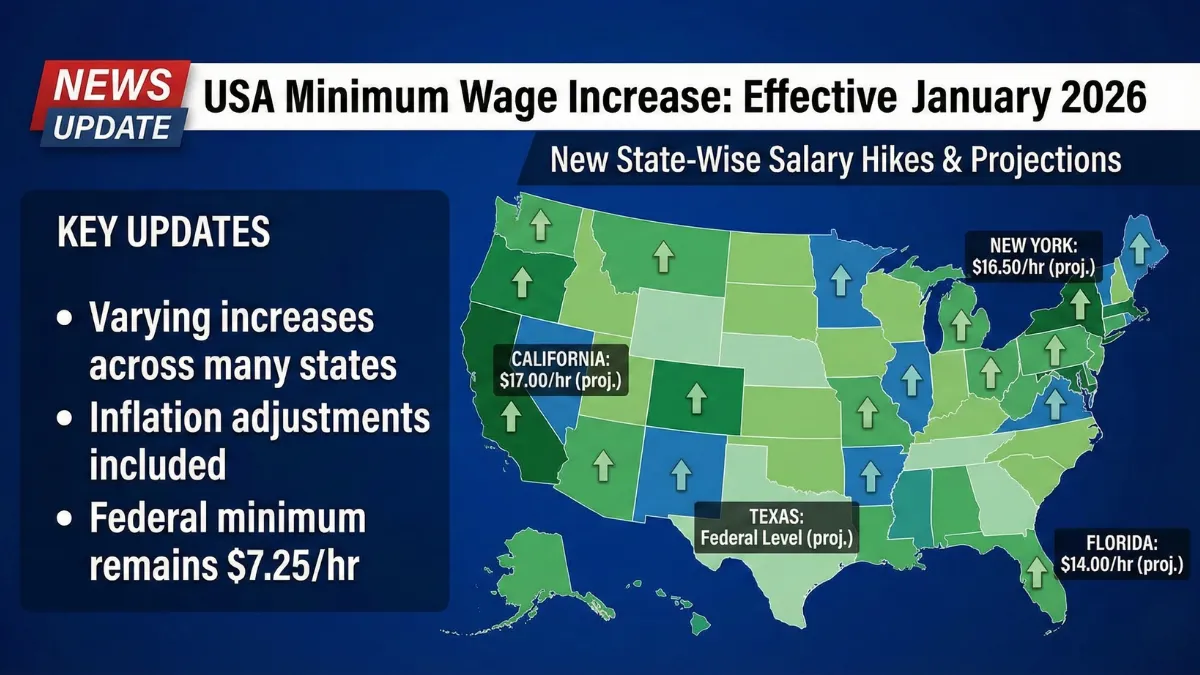

Starting January 2026, minimum wage increases across several US states are set to take effect, impacting millions of workers nationwide. While there is no single nationwide wage hike applied to all workers, many states and cities adjust their minimum wages annually based on inflation laws, voter-approved measures, or state legislation. This article explains how the January 2026 increases work, which states are affected, and how enforcement is handled under federal and state rules.

How Minimum Wage Changes Work in the United States

The US does not apply minimum wage increases uniformly. Instead, wages are determined at federal, state, and local levels, with employers required to pay the highest applicable rate. Oversight and compliance guidance are provided by the U.S. Department of Labor.

| Wage Authority | How Rates Are Set |

|---|---|

| Federal | Fixed national minimum |

| State | Laws or inflation indexing |

| City / County | Local ordinances |

| Employer Obligation | Pay the highest rate |

| Effective Date | Commonly January 1 |

Why January 2026 Is Important for Workers

Many states legally tie minimum wage increases to inflation or cost-of-living formulas, which automatically trigger new rates at the start of each year. January 2026 reflects these scheduled adjustments rather than emergency or temporary hikes.

State-Wise Minimum Wage Increase Pattern (2026)

While exact figures vary by state and city, common patterns include:

- Inflation-indexed increases in states with automatic adjustment laws

- Scheduled step-up increases approved in earlier legislation

- Higher local wages in major metro areas

- No change in states without adjustment laws

Employees should check state labor department notices for exact rates.

States Most Likely to See Increases

States with wage laws tied to inflation or pre-approved schedules typically raise wages every January. These states often update rates automatically without new legislation.

What Has NOT Changed in 2026

- No nationwide federal minimum wage hike has been enacted

- Employers may still set wages above minimum levels

- Tipped and youth wage rules remain state-specific

- Enforcement remains complaint-based and audit-driven

Who Benefits the Most From the 2026 Hike

- Hourly workers

- Retail and food service employees

- Part-time and seasonal workers

- Urban workforce in high-cost areas

What Employers Must Do

Employers are required to:

- Update payroll systems

- Display new wage notices

- Pay the highest applicable rate

- Comply with local ordinances

Failure to comply can result in penalties.

Key Points to Remember

- Minimum wage increases vary by state

- January 2026 is a common effective date

- Local wages may be higher than state rates

- Federal wage remains unchanged

- Employers must follow the highest rule

Conclusion

The USA minimum wage increase from January 2026 reflects scheduled state and local adjustments rather than a single national hike. Workers should verify their state and city wage rates, while employers must ensure compliance with updated laws to avoid penalties. Understanding how wage authority works helps both sides prepare for annual changes.

Disclaimer

This article is for informational purposes only and does not constitute legal or employment advice. Minimum wage laws vary by state and locality and are subject to change. Workers and employers should consult official state labor departments or the US Department of Labor for confirmed wage rates.