In 2026, updated rules for working while receiving Social Security benefits are affecting how much beneficiaries can earn, when benefits may be temporarily reduced, and how payments are recalculated later. These changes do not stop people from working, but they do change how earnings interact with monthly benefits depending on age and income level. This article explains the 2026 rules clearly, including earnings limits, benefit adjustments, and what workers should expect from the Social Security Administration.

How Working Affects Social Security Benefits in 2026

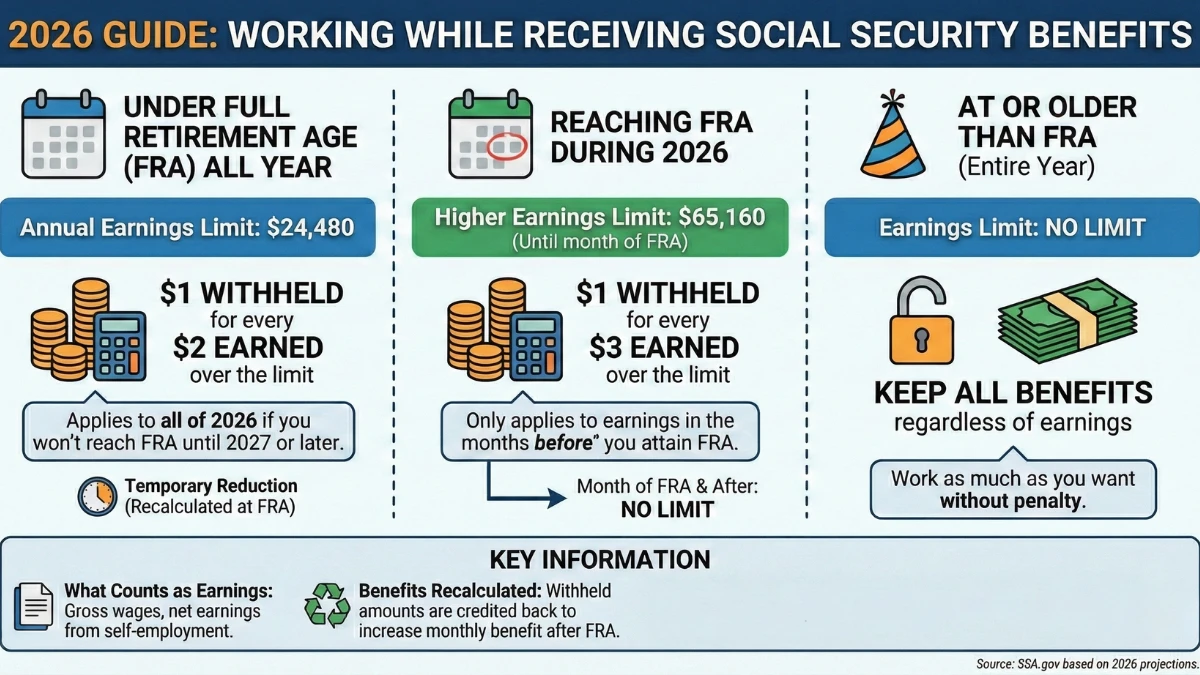

Social Security allows beneficiaries to work, but earnings limits apply if you claim benefits before reaching Full Retirement Age (FRA), which determines whether temporary benefit reductions occur.

| Age Category | 2026 Earnings Rule |

|---|---|

| Under Full Retirement Age | Benefits reduced if earnings exceed annual limit |

| Year You Reach FRA | Higher earnings limit applies |

| At or After FRA | No earnings limit |

| Reduction Method | Temporary withholding |

| Later Adjustment | Benefits recalculated upward |

Earnings Limit Rules Explained

If you are below Full Retirement Age, Social Security temporarily withholds part of your benefits when earnings cross the annual threshold. Once you reach FRA, those withheld amounts are factored back into future payments.

What Happens in the Year You Reach Full Retirement Age

A higher earnings limit applies only to income earned before the month you reach FRA, and benefit reductions stop entirely starting that month.

Working After Full Retirement Age

Once you reach FRA, you can earn unlimited income with no reduction to your Social Security benefits, regardless of how much you make.

How Benefit Reductions Actually Work

When earnings exceed limits, benefits are withheld temporarily, not permanently lost. The SSA recalculates your benefit amount after FRA to credit months when payments were reduced.

Which Types of Income Count

Only wages and self-employment income count toward the earnings limit. Pensions, investment income, rental income, and withdrawals from savings do not affect Social Security benefits.

Who Is Most Affected in 2026

- Early retirees working part-time

- Self-employed beneficiaries

- Those returning to work after claiming early

- Workers earning just above the limit

Key Rules to Remember (2026)

- Working is allowed at any age

- Earnings limits apply only before FRA

- Benefits are withheld, not lost

- Higher limit applies in FRA year

- No limit after FRA

Conclusion

The 2026 Social Security work rules make it clear that beneficiaries can continue working, but earnings affect benefits differently depending on age. While early claimants may see temporary reductions, those amounts are restored later through recalculated benefits. Understanding these rules helps workers plan income without unnecessary surprises.

Disclaimer

This article is for informational purposes only and does not constitute financial or retirement advice. Social Security rules, earnings limits, and benefit calculations are subject to official SSA updates. Beneficiaries should verify details through official Social Security Administration resources.