During recent tax seasons, many filers have noticed IRS refund adjustments of about $400, while others with seemingly similar returns receive exactly what they expected, creating confusion and concern. These differences are usually not random and rarely indicate penalties. This article explains why $400 adjustments happen, why some taxpayers are affected while others are not, and how the Internal Revenue Service applies corrections during processing.

What a Refund Adjustment Actually Means

A refund adjustment occurs when the IRS recalculates part of a tax return after filing, usually to correct figures related to income, credits, or withholding before releasing the final payment.

| Adjustment Area | Why It Happens |

|---|---|

| Tax Credits | Eligibility or amount corrected |

| Income Matching | Employer data mismatch |

| Withholding Totals | Amounts verified |

| Math Errors | Automatic IRS correction |

| Offsets | Prior balances applied |

Why $400 Is a Common Adjustment Amount

Adjustments near $400 often reflect partial credit changes or small withholding differences. These amounts are large enough to matter but small enough to be corrected automatically without triggering audits or major reviews.

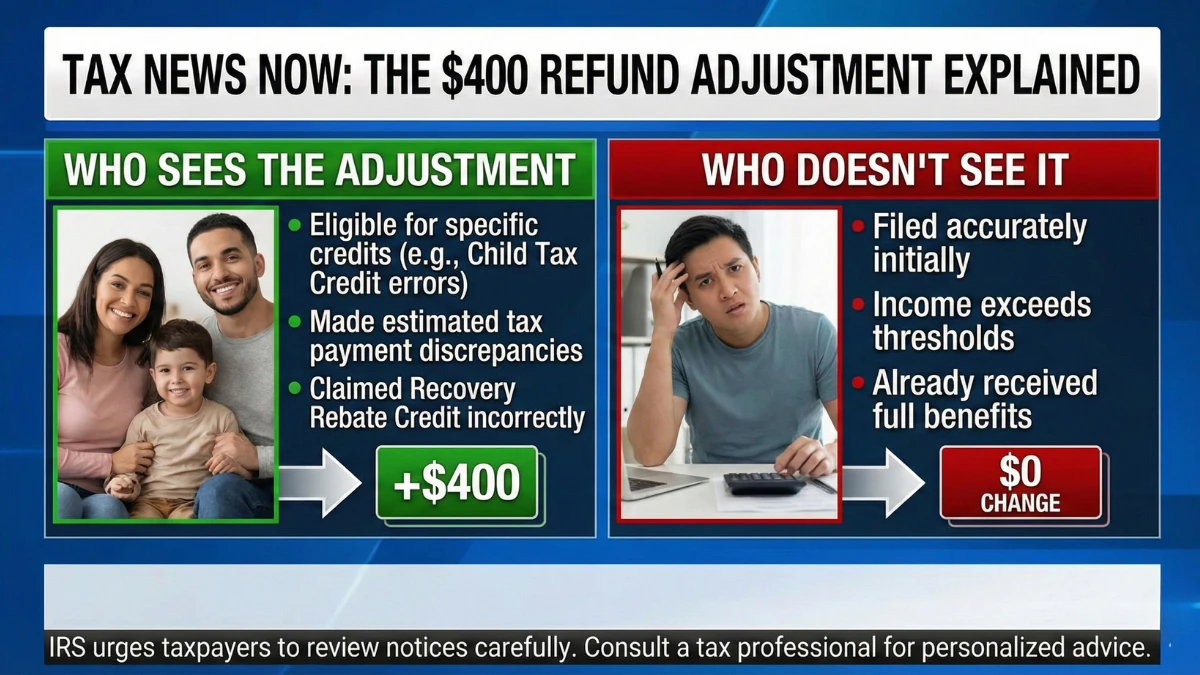

Why Some Taxpayers See Adjustments and Others Don’t

Returns that perfectly match IRS records usually pass through automated systems without changes. Returns with even minor discrepancies are automatically corrected, leading to adjustments that others never experience.

Does an Adjustment Mean You Made a Mistake

Not necessarily. Many adjustments are routine system corrections, not taxpayer errors. The IRS routinely fixes calculations or credit amounts without requiring action.

How Adjustments Affect Refund Timing

When a correction is made, the refund may be temporarily delayed while the new amount is finalized. Once complete, payment is released normally through direct deposit or check.

Will the IRS Notify You

Yes. If your refund is adjusted, the IRS generally sends a notice explaining the change, showing the original amount, the correction, and the revised refund total.

When You Should Take Action

Action is needed only if:

- You disagree with the adjustment

- The notice requests documents or clarification

- The adjustment impacts future filings

Otherwise, no response is required.

Key Points to Remember

- $400 adjustments are common and routine

- They usually involve credits or withholding

- Not all taxpayers are affected

- IRS sends notice when changes occur

- Most refunds proceed without issues

Conclusion

Seeing a $400 refund adjustment while others don’t is usually the result of routine IRS verification and correction, not unfair treatment or penalties. Small differences in income reporting, credits, or withholding can trigger adjustments for some taxpayers while others pass through unchanged.

Disclaimer

This article is for informational purposes only and does not constitute tax or financial advice. Refund adjustments depend on individual circumstances and IRS determinations. Always rely on official IRS notices or consult a qualified tax professional for guidance.