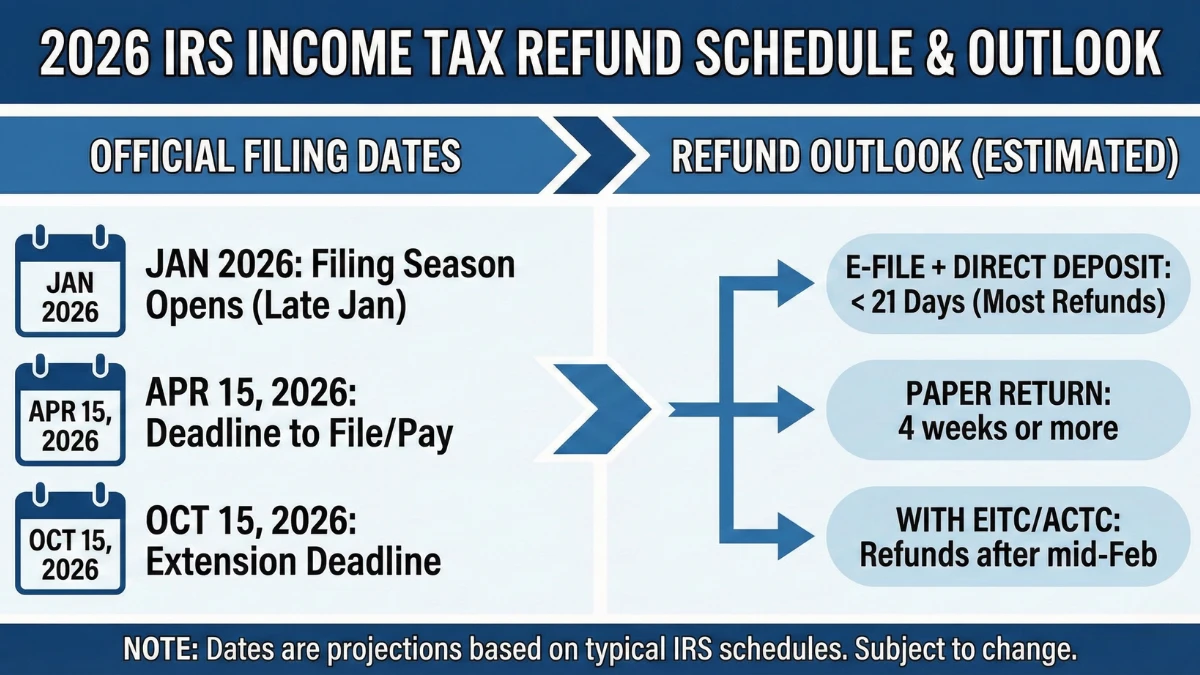

With the 2026 tax season approaching, taxpayers are actively searching for the IRS income tax refund schedule, official filing dates, and a realistic outlook on when refunds may arrive. While the IRS does not issue a fixed refund calendar for everyone, clear timelines can be estimated based on filing method, credits claimed, and review requirements. This article explains the official 2026 filing dates, expected refund windows, and how processing works at the Internal Revenue Service.

Official IRS Filing Dates for the 2026 Tax Season

The IRS sets a formal opening date each year to begin accepting and processing federal income tax returns. Returns submitted before this date are held and processed only once the filing season officially opens.

| Filing Stage | What It Means for Taxpayers |

|---|---|

| IRS Filing Opens | Returns are officially accepted |

| Early E-Filing | Held until processing begins |

| Paper Filing Start | Begins after season opens |

| Refund Processing | Starts after acceptance |

| Tracking Tools Active | After return is received |

Estimated 2026 IRS Refund Schedule

Refund timing depends largely on how you file and whether your return requires additional review.

| Filing Method | Estimated Refund Time |

|---|---|

| E-file + Direct Deposit | 10–21 days |

| E-file + Paper Check | 3–4 weeks |

| Paper File + Direct Deposit | 4–6 weeks |

| Paper File + Check | 6–8 weeks or longer |

| Returns With Credits | May take longer |

Why Refund Dates Are Estimates, Not Guarantees

The IRS processes each return individually. Refunds can move faster or slower depending on accuracy, verification checks, refundable credits, fraud screening, and bank posting timelines.

Refunds That May Take Longer in 2026

Returns claiming refundable credits, higher refund amounts, or income reconciliation are more likely to enter manual or extended review, which can delay payment beyond standard timelines.

How IRS Refund Status Updates Work

Refund status tools update once daily, usually overnight. Long gaps between updates are normal during verification and do not indicate that processing has stopped.

Does Filing Early Improve Refund Speed

Filing early can help place your return earlier in the processing queue, but accuracy matters more than speed. An early return with errors can take longer than a later, error-free filing.

What Taxpayers Can Do to Avoid Delays

Taxpayers can reduce delays by:

- Filing electronically

- Choosing direct deposit

- Double-checking income and credit entries

- Avoiding unnecessary amended returns

Key Points to Remember

- No fixed IRS refund calendar exists

- Most e-file refunds arrive within 21 days

- Credits and verification can slow refunds

- Bank posting affects deposit dates

- Status updates are not real-time

Conclusion

The 2026 IRS income tax refund schedule should be viewed as a set of estimated timelines rather than exact dates. Understanding official filing dates, refund processing steps, and verification requirements helps taxpayers set realistic expectations and avoid confusion during the 2026 tax season.

Disclaimer

This article is for informational purposes only and does not constitute tax or financial advice. Refund timing and eligibility depend on individual circumstances, IRS processing rules, and bank policies. Always rely on official IRS tools and notices for accurate information.