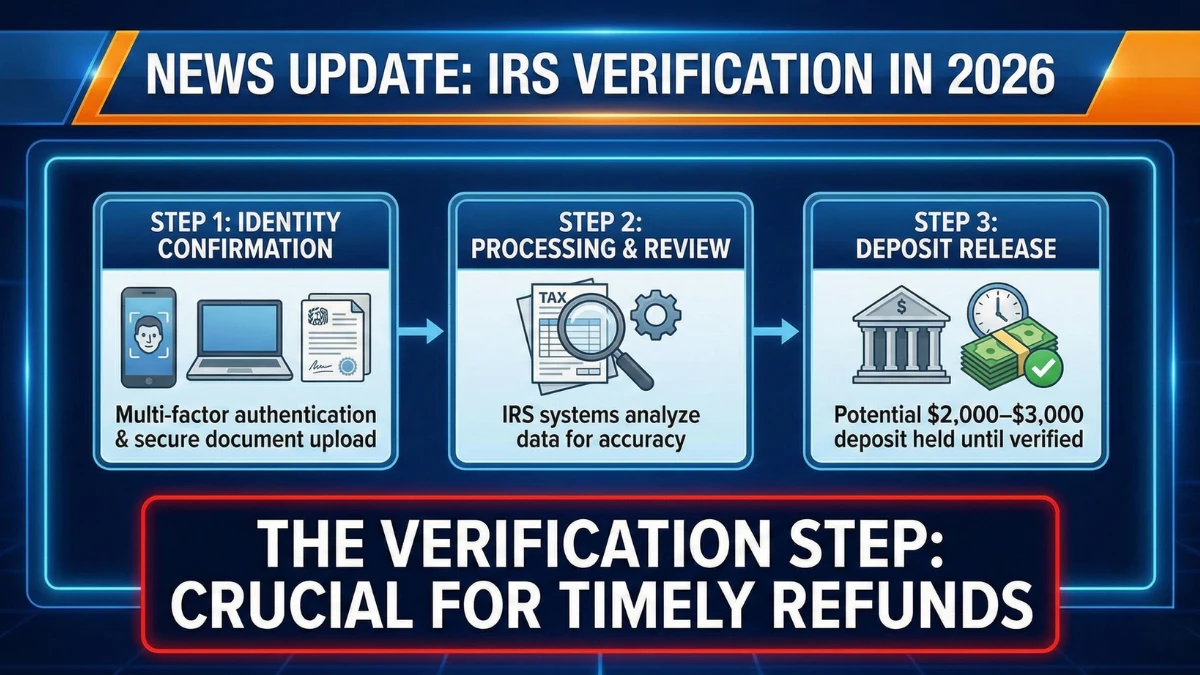

In the 2026 tax season, many taxpayers expecting $2,000–$3,000 IRS deposits are seeing their refunds pause during IRS verification, creating anxiety about delays or reductions. This verification step is a standard part of federal processing and does not automatically signal a problem. This article explains what IRS verification is, why it affects mid-to-higher refunds, and how the Internal Revenue Service uses it before releasing payments.

What IRS Verification Means in 2026

IRS verification is the process of confirming income, credits, withholding, and identity details before approving a refund. Returns that meet certain criteria are routed for extra checks to ensure accuracy and prevent fraud.

| Verification Area | Why It’s Checked |

|---|---|

| Refundable Credits | Eligibility confirmation |

| Income Matching | Employer and payer data |

| Withholding Totals | Payment reconciliation |

| Identity Validation | Fraud prevention |

| Return Accuracy | Math and entry checks |

Why $2,000–$3,000 Deposits Are Commonly Held

Refunds in the $2,000–$3,000 range often include a mix of credits and withholding adjustments, placing them above fast-track automated limits but below high-dollar thresholds—making them more likely to enter verification queues.

Does Verification Mean the Refund Is at Risk

No. Verification is not an audit and does not mean the refund will be reduced. Most verified returns are approved in full once checks are completed.

How Long Verification Can Delay Deposits

Verification can add several days to a few weeks, depending on IRS workload. Status tools may not update during this period, which can make the delay feel longer than it is.

IRS Approval vs Bank Posting

After verification and approval, the IRS releases funds, but banks control final posting times, which can add 1–3 business days before the deposit appears.

When the IRS Contacts Taxpayers

The IRS contacts taxpayers only if additional information is required. If no notice is issued, the verification is typically internal and requires no action.

What Taxpayers Should Do While Waiting

Taxpayers should monitor official refund status tools, avoid filing amended returns prematurely, and wait for an IRS notice before taking steps.

Key Points to Remember

- IRS verification is routine in 2026

- $2,000–$3,000 refunds are commonly reviewed

- Verification does not mean denial

- Most refunds are approved without changes

- Bank posting adds extra time

Conclusion

IRS verification in 2026 is a key step that can temporarily hold $2,000–$3,000 deposits, especially when credits and withholding overlap. While the wait can be frustrating, verification is a normal safeguard designed to ensure accurate and secure refunds—not a sign that funds are lost or reduced.

Disclaimer

This article is for informational purposes only and does not constitute tax or financial advice. Refund timing and outcomes depend on individual circumstances, IRS processing rules, and bank policies. Always rely on official IRS tools and notices for accurate information.