With guaranteed returns and government backing, Post Office Fixed Deposits (FDs) remain a preferred choice for risk-averse investors in 2026. As interest rates and tenures vary, using a Post Office FD calculator helps investors instantly estimate maturity value and total interest before investing. This article explains how the calculator works, current FD options, and what investors should know before locking in their money with India Post.

What Is the Post Office FD Calculator?

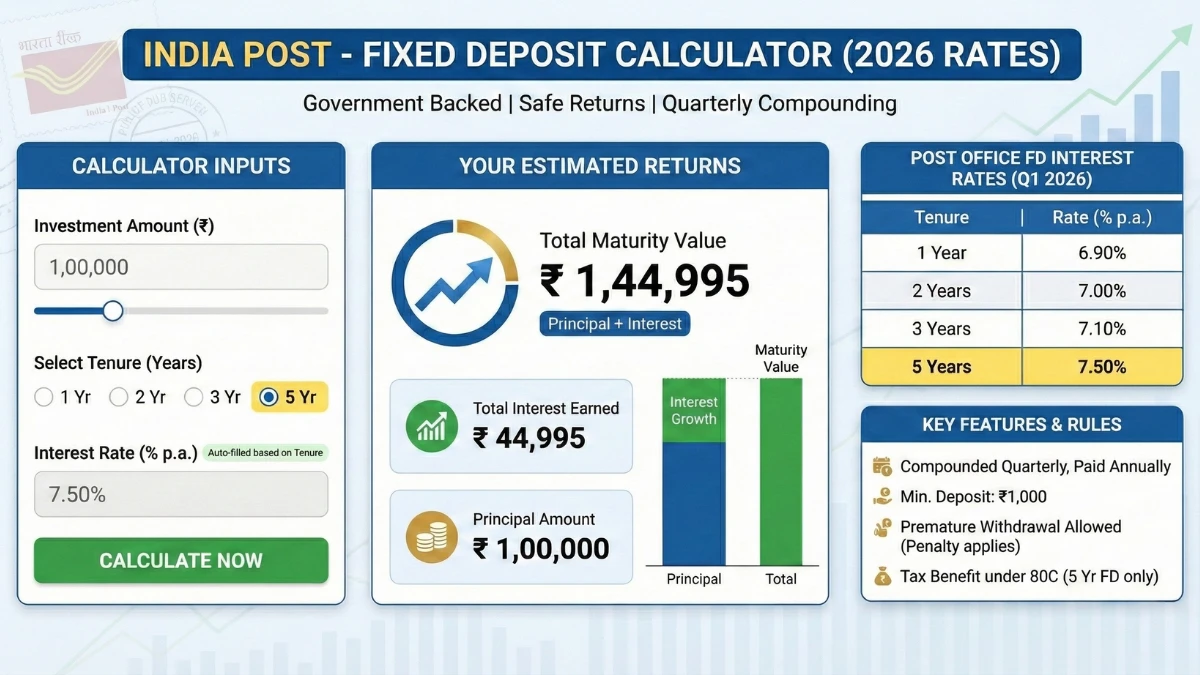

The Post Office FD calculator is a simple tool that estimates how much your deposit will grow over a fixed tenure based on the applicable interest rate. It gives clarity on maturity value, helping investors compare returns across tenures without manual calculations.

| Calculator Input | What It Determines |

|---|---|

| Deposit Amount | Principal invested |

| FD Tenure | 1, 2, 3, or 5 years |

| Interest Rate | As notified by government |

| Compounding | Annual |

| Maturity Value | Final amount receivable |

Post Office FD Interest Rates in 2026

Post Office FD rates are reviewed quarterly by the government and are generally aligned with small savings schemes. Rates differ by tenure, making the calculator essential for choosing the most rewarding option.

How the Post Office FD Calculator Works

The calculator applies annual compounding interest to your deposit for the selected tenure. Once you enter the amount and duration, it instantly displays the maturity value and interest earned, removing guesswork from investment planning.

Example: FD Maturity Calculation

If you invest a fixed amount for a chosen tenure, the calculator shows the exact maturity payout, allowing you to plan future expenses such as education, retirement needs, or emergency funds.

Why Investors Prefer Post Office FDs

Post Office FDs are backed by the Government of India, making them one of the safest fixed-income options. They also offer flexibility in tenure and predictable returns, which appeals to conservative investors.

Tax Rules You Should Know

Interest earned on Post Office FDs is taxable as per your income slab. However, 5-year Post Office FDs qualify for Section 80C tax benefits, making them attractive for tax-saving purposes.

Who Should Use the Post Office FD Calculator

The calculator is ideal for senior citizens, salaried individuals, retirees, and first-time investors who want clarity on returns before committing funds to a fixed deposit.

Key Facts to Remember

- FD tenures range from 1 to 5 years

- Interest is compounded annually

- Rates are revised quarterly

- 5-year FD offers tax benefits

- Calculator gives instant estimates

Conclusion

The Post Office FD Calculator 2026 is a powerful yet simple tool for investors seeking safe and predictable returns. By instantly showing maturity value and interest earnings, it helps investors make informed decisions and choose the right tenure with confidence.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Interest rates, tax rules, and scheme details may change based on government notifications. Investors should verify current rates and terms with official India Post sources before investing.