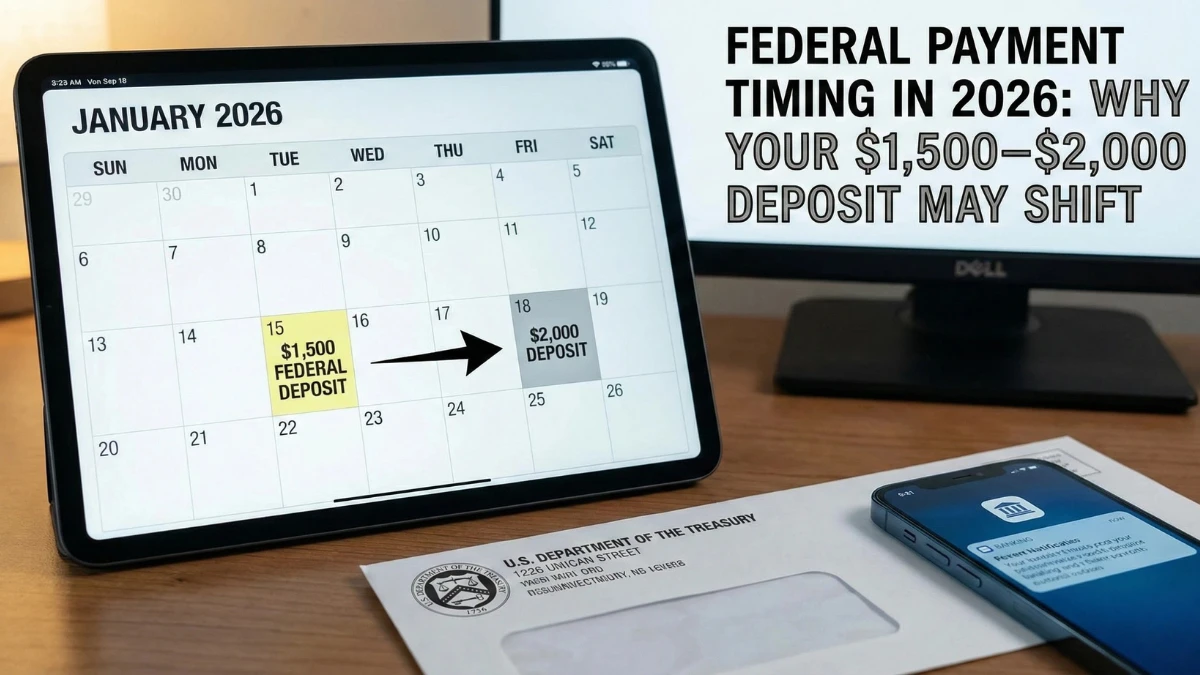

Many beneficiaries expecting a $1,500–$2,000 federal deposit in 2026 are noticing changes in timing compared to earlier years, leading to confusion and concern. Federal payments do not always arrive on fixed calendar dates, and even small administrative or banking factors can cause delays or early postings. This article explains why payment timing can shift, which agencies are involved, and what recipients should realistically expect.

Which Federal Agencies Control Payment Timing

Federal payments are authorized and coordinated by the Government of the United States, while processing and scheduling are often handled by specific agencies such as the Internal Revenue Service or benefit administrators depending on the payment type.

| Agency | Role in Payment Timing |

|---|---|

| U.S. Treasury | Releases federal funds |

| IRS | Tax refunds and credits |

| SSA | Social Security payments |

| Benefit Agencies | Program-specific payouts |

| Banks | Final posting to accounts |

Why Federal Payments Do Not Arrive on the Same Date

Federal deposits vary because they depend on processing cycles, eligibility verification, and authorization timing. Payments are released in batches, meaning not everyone receives funds on the same day.

Why $1,500–$2,000 Amounts Are Common

Amounts in this range often appear due to tax refunds, benefit adjustments, credits, or partial back payments, rather than a single uniform federal program. Different eligibility profiles result in different final amounts.

Key Reasons Payment Timing May Shift in 2026

Several factors can affect when deposits arrive:

- Processing backlogs or verification checks

- Filing or eligibility confirmation dates

- Federal holidays and weekends

- Bank posting schedules

- Program-specific release timelines

What Beneficiaries Should Do If a Payment Is Delayed

Delays do not automatically mean a payment is denied. Beneficiaries should check official tracking tools, confirm bank details, and wait for standard processing windows before escalating concerns.

How to Check Your Federal Payment Status

Always use official government portals, agency dashboards, or direct communications to check payment status, as third-party websites and social media claims are often inaccurate.

- Federal payments are released in batches, not one day

- $1,500–$2,000 amounts vary by eligibility

- Bank posting times can differ by institution

- Holidays and verification can cause delays

- Official tools provide the most accurate updates

Conclusion

Shifts in federal payment timing during 2026 are usually the result of administrative processing, eligibility checks, or banking schedules rather than payment cancellation. Beneficiaries expecting $1,500–$2,000 deposits should rely on official agency updates and allow for standard processing variations before assuming a problem.

Disclaimer

This article is for informational purposes only and does not constitute legal, tax, or financial advice. Federal payment amounts, eligibility, and timing are subject to government decisions and official notifications.