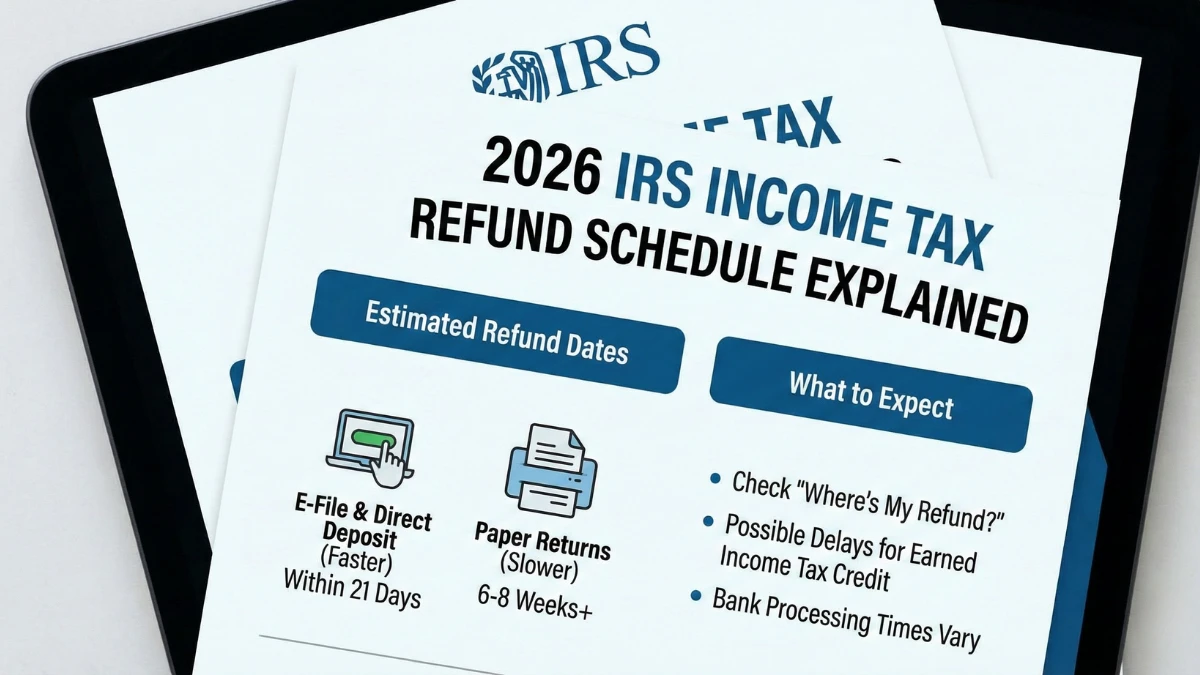

As the 2026 tax season begins, taxpayers are searching for the IRS income tax refund schedule to understand when their refunds might arrive and why timelines differ from filer to filer. While the IRS does not publish an exact refund calendar for each taxpayer, estimated refund windows can be predicted based on filing method, credits claimed, and verification steps. This article explains the expected 2026 refund schedule, common timing ranges, and how processing works at the Internal Revenue Service.

When the IRS Starts Processing 2026 Tax Returns

The IRS begins accepting and processing 2026 tax returns once the filing season officially opens. Returns submitted before the opening date are held and processed only after systems go live.

| Filing Method | Estimated Refund Timing |

|---|---|

| E-file + Direct Deposit | 10–21 days after acceptance |

| E-file + Paper Check | 3–4 weeks |

| Paper File + Direct Deposit | 4–6 weeks |

| Paper File + Check | 6–8 weeks or longer |

| Returns With Credits | Additional delays possible |

Estimated 2026 IRS Refund Date Ranges

Most taxpayers who e-file with direct deposit can expect refunds within two to three weeks, assuming no issues arise. Refunds may take longer for returns that require extra review or manual verification.

Why Some Refunds Arrive Faster Than Others

Refund timing varies due to:

- Return accuracy

- Credits claimed

- Income verification

- Fraud-prevention checks

- Bank posting schedules

Even returns filed on the same day can have very different deposit dates.

Refunds That May Take Longer in 2026

Returns claiming refundable credits, higher refund amounts, or income reconciliation are more likely to be routed for manual review, extending processing time beyond standard estimates.

IRS Refund Status Tool Timing

The IRS refund status tool updates once per day, usually overnight. Status messages may remain unchanged for days during verification, which does not mean processing has stopped.

Does Filing Early Guarantee a Faster Refund

Filing early can help place a return in the processing queue sooner, but it does not guarantee immediate payment. Accuracy and verification requirements matter more than filing date alone.

What Taxpayers Should Do to Avoid Delays

Taxpayers can reduce delays by:

- Filing electronically

- Choosing direct deposit

- Double-checking income and credit entries

- Avoiding amended returns unless required

Key Points to Remember

- No exact IRS refund calendar exists

- Most e-file refunds arrive within 21 days

- Credits and verification slow processing

- Bank posting affects final deposit timing

- Status updates are not real-time

Conclusion

The 2026 IRS income tax refund schedule is best understood as a set of estimated timing ranges rather than fixed dates. While many taxpayers will receive refunds within a few weeks, others may experience delays due to credits, verification, or bank processing. Knowing how the system works helps set realistic expectations during tax season.

Disclaimer

This article is for informational purposes only and does not constitute tax or financial advice. Refund timing depends on individual circumstances, IRS processing rules, and bank policies. Always rely on official IRS tools and notices for accurate updates.